At this time, self-service wires and International Money Transfers are available in all regions.

In Online Banking:

- Sign on to PNC Online Banking.

- Select the Transfer Funds tab

- Select Send a Wire or International Transfer.

In the PNC Mobile App:

- Log into the PNC Mobile App.

- Go to the Transfer tab.

- Choose Send a Domestic Wire or Send an International Transfer.

For additional questions, select “Message PNC” on the right hand side of your PNC Online Banking “My Account” tab.

To process a wire or International Money Transfer we will need the following information about your recipient:

- Name of person or business

- Address

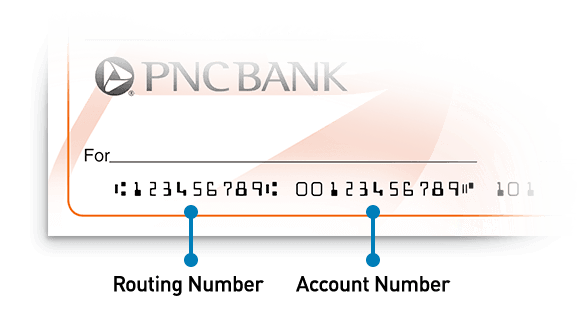

- Bank routing number

- Account number

If you are requesting a wire within a branch, you will also be asked to provide valid photo ID.

Additionally, depending on the type of transfer, we will need information about the recipient’s account:

- Domestic wires require a U.S. routing and full account number. Keep in mind that many banks have a specific routing number for wires. Your recipient should contact their bank with questions.

- International wires require either an international bank account number (IBAN) or a full account number and SWIFT code, also known as a Business Identifier Code (BIC). Your recipient should contact their bank with questions.

- International Money Transfers require a full account number. Certain banks may accept the recipient’s debit card number or mobile phone number in lieu of an account number.

Fees for sending a wire or International Money Transfers vary by account type, see your fee schedule or call us at 1-800-272-6868 for details.

Perform a Domestic Wire Transfer:

You can request to send a domestic wire from any personal PNC checking or savings account within the Transfer Funds tab of your online banking, or within the Transfers section of the PNC Mobile App.

- You can also contact a local branch for an appointment to complete your domestic wire. More information on current branch services can be found in our branch locator

- If you prefer, you can also call our Wire Transfer Customer Care center 1-800-272-6868 Monday through Friday, 8:30 A.M. – 4 P.M. EST to request a domestic wire transfer. For PNC General Customer Service, contact 1-888-762-2265.

Only send money to people and businesses you know and trust.

Perform an International Wire or International Money Transfer:

You can request to send an international wire or International Money Transfer from any personal PNC checking or savings account within the Transfer Funds tab of your online banking, or within the Transfers section of the PNC Mobile App.

- You can also contact a local branch for an appointment to complete your international wire or International Money Transfer. More information on current branch services can be found in our branch locator

We are not able to process requests for international transfers over the phone.

Only send money to people and businesses you know and trust.

Note: to process a domestic wire transfer over the phone, you may need to complete a Wire Transfer Agreement. The form can be found by signing into Online Banking and visiting the Customer Service tab / Online Documents Center. Domestic wire transfer may not be available same day. In some instances, requests may not be processed until the following business day. We may attempt to call you to verify your wire instructions. Incorrect information or delays in reaching you may delay the processing of your wire transfer.

To receive an incoming international Wire Transfer you will need PNC Bank's SWIFT Code (BIC): PNCCUS33.