Check with your phone service provider for specific international calling instructions, rates and charges that may apply. Collect calling availability varies by country and may require a local operator.

Customer Service & Support

How can we help you today?

Browse By Products

Service & Support Information for Your Existing Account or Loan

Frequently Asked Questions

Find Answers to Commonly Asked Account Questions

Routing numbers are nine digit numbers that can also be referred to as banking routing numbers, routing transit numbers, RTNs, and ABA numbers. This code identifies your financial institution and it can differ depending on where you opened your account and the type of transaction you make.

There's a number of ways you can find your Account and Routing numbers:

PNC Mobile App

For all Deposit Accounts (Checking and Savings)

- Sign in to the Mobile app.

- Select your account, then select Account and Routing Numbers.

- Verify your identity by entering a one-time passcode to view your full account number and routing number.

Online Banking

For Deposit Accounts (Checking and Savings)

- Sign on to Online Banking and select your account.

- For Virtual Wallet accounts, go to Account Activity, change the selected Virtual Wallet account from the dropdown if needed, and select Go to the Account and Routing Number link.

- For all other checking and savings accounts, select the Show Account & Routing Number link.

- Verify your identity by entering a one-time passcode and follow the instructions for viewing your full account number and routing number.

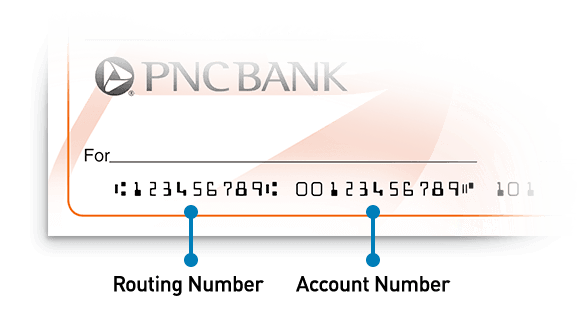

On Your Paper Checks:

Your Account number and Bank (ABA) Routing number can be found at the bottom of your checks:

If you don’t have your checkbook handy, don’t worry. If you have recently written a check that has posted to your account you can:

- Sign on to Online Banking.

- Select your account.

- Within the Posted Transactions section of the Account Activity page, locate a recently posted check and click on the blue hyperlink under the Description column.

- View an image of the check to obtain the routing and account number.

Incoming Wire Transfers

Incoming wire transfers have a different routing number than the one displayed on your account. To set up an incoming wire transfer, you’ll need to provide your account number and the following PNC Bank Routing Number: 043000096.

If you forget your Password, you can reset it online with your debit card information or a phone number that you have enrolled through Online Banking.

To reset your Password and regain access immediately, click on "Forgot Your User ID or Password?" located in the Online Banking Sign On block on pnc.com. This link will walk you through the steps necessary to reset your Password

If you forget your User ID, you will need to contact us directly by either calling us or stopping into any of our PNC Branches to obtain this information.

It's easy to change the address you have on file with PNC for your accounts:

In Online Banking, Click on the Customer Service tab and then select the "Customer Profile" option at the top. You'll see your personal information.

To update your mailing address:

- Click "edit" next to the Customer Address section.

- Place a check next to the account(s) that you would like to change.

- Type in your new address and click the "next" button.

- Confirm that the new address is correct and click the "submit modifications" button.

To update your phone number:

- Click “edit” next to the Telephone Numbers section.

- Delete the digits in either the Primary and Secondary fields.

- Click the “Next” button.

To update your email address:

- Click “edit” next to the Email Addresses section.

- Type in your new email address.

- Confirm your new email address by reentering it.

- Click the “Submit Modifications” button.

For international address change requests, connect with us using Message PNC in the PNC Mobile app or Online Banking. Include your phone number and a physical, international address or a Military Box address.

For Business Accounts: In order to change the address on record, please contact the PNC Business Banking Care Center at 1-877-287-2654. Some business accounts will require a visit to your local PNC branch to change the address.

It’s easy to order checks with Online Banking:

- Sign in to Online Banking

- Click on the Customer Service Tab

- In the Manage Accounts section, click on Order Checks & Supplies.

- Click on the “Checks/Supplies” link under the Order column next to the account for which you want to order checks.

Sign up for Automatic Check Reorder so you don’t have to remember about reordering checks.

Automatic Check Reorder is a free service offered by PNC that notifies you when 70% of your checks are gone. At that time, you can make changes to your check style or address. Your new checks will be mailed to you automatically

Not sure if you’re already enrolled in Automatic Check Reorder?

- Sign in to Online Banking

- Click on the Customer Service Tab

- In the Manage Accounts section, click on "Order Checks & Supplies".

You will see a list of your open accounts. Look in the Automatic Check Reorder column and it will state “Enabled” for the accounts that are enrolled.

Setting up alerts is easy once you're logged into Online Banking.

- From your Alerts tab, access the Alert Profile Page.

- The Alert Profile Page provides a snapshot view of all the alerts eligible for each account.

- From there, you can add/view or edit account and security alert settings.

The following types of Alerts are available:

- Deposit Account Alerts

- Credit Card Alerts (provide balance & payment information)

- Debit/Credit Card Transaction Alerts

- Security Alerts

- Service Alerts

You can set up your account(s) to receive alerts via email or text messages[2].

You can dispute some debit or credit card transactions electronically via your Online Banking by going to the Customer Service tab.

There are two separate processes for debit card and credit card transactions after you go to the Customer Service tab.

To dispute a debit card transaction:

- Sign On to PNC Online Banking.

- Click the "Customer Service" tab.

- Select "Dispute a Transaction” from the Account Services section.

- Select the account associated with the dispute, and confirm your address.

- Click "Next."

- Select the transaction you wish to dispute from the transaction list. If you don't see see the transaction you wish to dispute or have other questions, please contact us at 1-888-PNC-BANK (762-2265).

- The steps that follow will walk you through how to place the dispute. If you have any other questions or concerns, please contact us.

To dispute a credit card transaction:

- Sign On to PNC Online Banking.

- Click the "Customer Service" tab.

- Select "Dispute a Transaction” link under “Credit Card”.

- Select the account associated with the dispute, and enter information regarding the disputed transaction.

- Click "Send".

- If you have any other questions or concerns please contact us.

You were charged a fee because your account was overdrawn.

There were not enough funds in your account to pay for all of the transactions that were posted to your account. Fees may be charged for each Overdraft Item (OD) or Returned Item (NSF).

If you sign on to Online Banking, you can view the transactions that led to your overdraft by clicking on the Overdraft Item Fee or Returned Item (NSF) Fee.

PNC customers with a Virtual Wallet Spend account and all other consumer checking/savings account types: You won’t be charged a Returned Item fee (also known as Non-Sufficient Funds or NSF) for an item that is returned unpaid. You may see a maximum of one Overdraft fee per business day. If there are additional overdrafts on the same business day, those items will be paid or returned with no additional fees.

PNC customers with business checking/savings account types: You may see a maximum of four Overdraft or Returned Item (NSF) fees per business day.

Please refer to the appropriate Consumer and Business Schedule of Services and Fees for additional information.

A "Stop Payment" allows you to stop payment on a check, range of checks or pre-authorized payment (excluding cashier's checks, money orders or other cash equivalent items).

To place a Stop Payment:

- Sign On to PNC Online Banking.

- Click the "Customer Service" tab.

- Select "Stop Payment" from the Account Services section.

- Select the type of stop that you would like to place.

- The screens that follow will walk you through the remaining steps to place the stop payment.

All Stop Payment requests on a pre-authorized payment must be received by PNC at least three (3) business days before the payment is scheduled to be made. Once placed, Stop Payment orders remain effective for six (6) months from the date authorized. You can place another stop payment order for an additional six months when the expiration date arrives.

Stop Payment requests on checks are not effective if, either before or within 24 hours from the time when the stop payment was requested, PNC Bank cashes the check or has become otherwise legally obligated for its payment. PNC Bank will assume no responsibility if any information provided is incorrect or incomplete and would cause the check or pre-authorized payment or transfer order to be paid (i.e., incorrect check number, date, account number, or invalid amount).

Please note that additional fees may apply. For more information, refer to the applicable schedule of service charges and fees:

If your card has been lost or stolen, resolve this through the PNC Mobile App[3] or Online Banking. Or, contact us immediately at one of the following phone numbers.

Step by Step Instructions to issue a new Debit Card

Step by Step Instructions to report your Credit Card lost or stolen.

Step by Step Instructions to issue a Credit Card replacement.

Personal Debit Cards

1-888-PNC-BANK (1-888-762-2265)

Business Debit Cards

1-877-BUS-BNKG (1-877-287-2654)

PNC Premier Traveler Visa® Signature Credit Card

1-877-588-3602

PNC Premier Traveler Reserve Visa® Signature credit card

1-877-631-8996

All other personal credit cards

1-800-558-8472 (domestically) or 1-412-803-7787 (internationally) [1]

Business Credit Cards

1-800-474-2101 (domestically) or 1-412-803-7787 (internationally) [1]

For credit cards, please call us at the appropriate number above.

Our toll-free Customer Service number will get you fast, easy and secure account information from our automated banking system. There's no waiting and it's available anytime, whenever you need it. Use it to check balances, hear account activity, transfer funds and much more.

To access the Automated Telephone Banking Service, you will need the following:

- Your User ID you associated with your account, as well as

- Your Telephone PIN Number you registered with your account (in many cases, this is the same as your PNC Debit Card PIN).

Once you enter the information required to access your account, just follow the instructions given to you through the automated system

At this time, self-service wires and International Money Transfers are available in all regions.

In Online Banking:

- Sign on to PNC Online Banking.

- Select the Transfer Funds tab

- Select Send a Wire or International Transfer.

In the PNC Mobile App:

- Log into the PNC Mobile App.

- Go to the Transfer tab.

- Choose Send a Domestic Wire or Send an International Transfer.

For additional questions, select “Message PNC” on the right hand side of your PNC Online Banking “My Account” tab.

To process a wire or International Money Transfer we will need the following information about your recipient:

- Name of person or business

- Address

- Bank routing number

- Account number

If you are requesting a wire within a branch, you will also be asked to provide valid photo ID.

Additionally, depending on the type of transfer, we will need information about the recipient’s account:

- Domestic wires require a U.S. routing and full account number. Keep in mind that many banks have a specific routing number for wires. Your recipient should contact their bank with questions.

- International wires require either an international bank account number (IBAN) or a full account number and SWIFT code, also known as a Business Identifier Code (BIC). Your recipient should contact their bank with questions.

- International Money Transfers require a full account number. Certain banks may accept the recipient’s debit card number or mobile phone number in lieu of an account number.

Fees for sending a wire or International Money Transfers vary by account type, see your fee schedule or call us at 1-800-272-6868 for details.

Perform a Domestic Wire Transfer:

You can request to send a domestic wire from any personal PNC checking or savings account within the Transfer Funds tab of your online banking, or within the Transfers section of the PNC Mobile App.

- You can also contact a local branch for an appointment to complete your domestic wire. More information on current branch services can be found in our branch locator

- If you prefer, you can also call our Wire Transfer Customer Care center 1-800-272-6868 Monday through Friday, 8:30 A.M. – 4 P.M. EST to request a domestic wire transfer. For PNC General Customer Service, contact 1-888-762-2265.

Only send money to people and businesses you know and trust.

Perform an International Wire or International Money Transfer:

You can request to send an international wire or International Money Transfer from any personal PNC checking or savings account within the Transfer Funds tab of your online banking, or within the Transfers section of the PNC Mobile App.

- You can also contact a local branch for an appointment to complete your international wire or International Money Transfer. More information on current branch services can be found in our branch locator

We are not able to process requests for international transfers over the phone.

Only send money to people and businesses you know and trust.

Note: to process a domestic wire transfer over the phone, you may need to complete a Wire Transfer Agreement. The form can be found by signing into Online Banking and visiting the Customer Service tab / Online Documents Center. Domestic wire transfer may not be available same day. In some instances, requests may not be processed until the following business day. We may attempt to call you to verify your wire instructions. Incorrect information or delays in reaching you may delay the processing of your wire transfer.

To receive an incoming international Wire Transfer you will need PNC Bank's SWIFT Code (BIC): PNCCUS33.

PNC provides a wide range of services to non-English speaking customers, including:

- Customer service with interpretation services available in more than 240 languages.

- Bilingual employees at certain branch locations

- Various resources in Spanish, including educational materials, a designated Customer Care Center line, 1-866-HOLA-PNC, and webpages in Spanish, including pnc.com/espanol.

- ATMs featuring languages such as Chinese, French, German, Italian, Japanese, Korean, Polish, Portuguese, Spanish and Vietnamese.

To ask to speak to an interpreter in one of over 240 languages, call 888-PNC-Bank (888-762-2265.)

Please visit our Language Services Support page for resources available in multiple languages to help you understand and use PNC's products and services.