Association for Financial Professionals: 2019 AFP Payments Fraud and Control Survey

Fraud Mitigation Solutions

For Small Business

Help Stop Fraud in Its Tracks

It’s no secret: The number and complexity of fraud schemes perpetrated against business checking accounts is continuing to grow. Seventy-eight percent of finance professionals report that their organizations were targets of payments fraud. Seventy percent of organizations subject to payments fraud were victims of check fraud.[1]

Do you have measures in place to help combat this type of attack?

Protect your business from the growing threat of fraud

As fraud becomes more sophisticated, recognizing the criminals' tactics and understanding how you can protect your business are more vital than ever.

Online Fraud Mitigation Tools

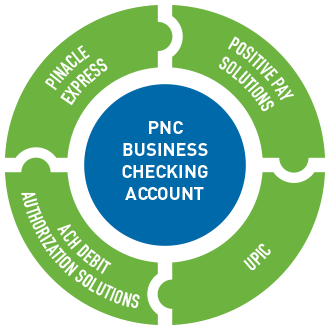

This comprehensive fraud mitigation approach combines four advanced technologies and security tools designed to help you identify and thwart attempts to compromise your financial accounts. By providing enhanced insight into the transactional details of your financial accounts, fraudulent checks and electronic transactions become easier for you to identify if presented for payment.

Here's How the Tools Work Together

These four tools, working together, can help you protect your account from unauthorized activity, whether initiated electronically via ACH, or manually via paper check.

- PINACLE® — Provides you with access to treasury management solutions that enable you to monitor and manage your banking activity from anywhere you have Internet access

Learn More about PINACLE - Positive Pay Solutions — Display your check presentment information online to help identify and respond to suspicious activity

Learn More about Positive Pay - ACH Debit Authorization Solutions — Stop all ACH debits from posting to your account or establish “rules” for filtering and decisioning which ACH items post, or are returned to the originator as unauthorized

Learn More about ACH Debit Authorization Solutions - Universal Payment Identification Code (UPIC) — Masks your checking account number so you can accept ACH credits without having to provide your PNC account number to the payment sender

Learn More about UPIC

Fraud Mitigation Solutions from PNC

Harness the strength of four treasury management solutions — PINACLE, Positive Pay, ACH Debit Authorization and UPIC — to help you identify and thwart attempts to compromise your financial accounts.

Insights

Insights and ideas to help you get the most out of your day and keep your business moving forward.

Manage Business Finances

How Healthcare Practices May Improve Cash Flow & Reduce Billing Delays

Healthcare practices may strengthen cash flow by streamlining billing, improving patient collections, and leveraging banking tools.

5 min read

Manage Business Finances

Retail Fraud Prevention: How To Protect Your Transactions & Accounts

Understanding how to protect your small business from retail fraud with secure payments, monitoring, and account protection tools is vital.

3 min read

Manage Business Finances

What Every Small Business Needs to Know About Fraud

As fraud becomes more sophisticated, recognizing the criminals’ tactics and understanding how you can protect your business are more vital than ever.

4:47 min video