PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the PNC Online Banking Service Agreement.

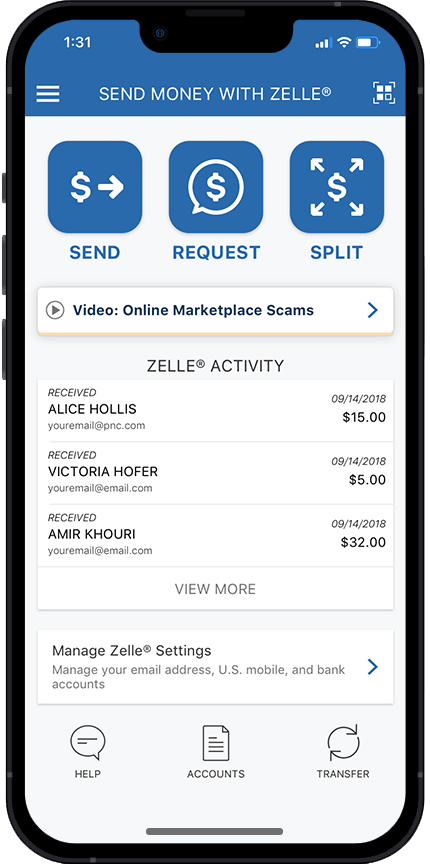

Zelle® for Your Business

A Fast and Easy Way to Receive Payments from Customers, Directly to Your Eligible PNC Business Checking Account—

Free in the PNC Mobile App.[1]

Overview

Zelle® is a fast and easy way for eligible businesses to send, receive, and request payments directly between bank accounts in the U.S.

If your customers are enrolled with Zelle® through a financial institution[2], they can send payments directly to your eligible PNC business checking account with just your email address, U.S. mobile phone number, or Zelle® QR Code. With Zelle®, money typically arrives within minutes between enrolled users.

Review the videos on pnc.com/ZelleVideos to learn more about how to use Zelle® safely.

Zelle® Fast Facts

What is Zelle®, and how does it work?

What are the benefits of using Zelle® for business owners?

How to avoid scammers when using Zelle®

How can I help protect my money while using Zelle®?

Zelle® Features

Zelle® Ready Contacts

With Zelle® Ready Contacts, it's easy to see which of your vendors and customers are enrolled with Zelle®.

Zelle® QR Codes

With Zelle® QR codes, it's even easier to receive payments from your customers with Zelle® in the PNC Mobile app.

Zelle® Widgets

What's a Zelle® widget, and why would I want one for my business?

Eligibility

Who is Eligible?

You may be eligible to use Zelle® for your business if you own a business that provides services to people or other eligible businesses you know and trust[2], such as:

- Landlords collecting rent.

- Health and beauty services: hairstylists, manicurists, massage therapists, estheticians, personal trainers.

- Home care services: landscapers/lawn care providers, tree trimmers, gardeners, snow removal services, pool services, cleaning services.

- Adult and child care providers.

- Therapists: speech, physical, psychologist.

- Lesson providers/coaches: music, tutoring, dance, sports.

- Professional services: photographers, accountants, consultants, financial planners, event planners.

- Pet services: dog walkers, pet sitters.

PNC does not recommend the use of Zelle® for the buying or selling of goods. Neither PNC nor Zelle® offers purchase protection for payments made with Zelle® – for example, if you do not receive the item you paid for, or the item is not as described or as you expected.

Benefits

Benefits to the Business Owner

Faster Access to Funds

- No more delays. Enrolled business customers typically receive payments within minutes, not days.

- No need to worry about returned check deposits or misplaced check or cash payments.

Seamless Experience

- Simply request and receive payments on any day and at any time.

- Zelle® is built into the existing PNC Mobile App, so there’s no need to download another app.

- All transactions are recorded in your bank account activity, which makes reconciliation easy.

Limit Account Detail Sharing

- Reduce exposure of sensitive information by not sharing or requiring bank account numbers.

Request, Receive and Send to Almost Anyone

- As a business, you can manage your accounts payable and accounts receivable with any consumer or business enrolled with Zelle® through their financial institution.

Zelle® is More Convenient Than Cash and Checks

- Enhance cash flow. No need to wait for checks to clear because payments are sent directly to your PNC Business Checking account, typically within minutes[2].

- Money is sent directly to your PNC Business Checking account, so there’s a record of all payments received, and no need to store or transport cash and checks.

- Customers can pay you with Zelle® right from their banking app, so you can receive payments at any time (no extra hardware required) and skip the trip to the bank.

- Receive money by sharing just your email address, U.S. mobile number, or Zelle® QR Code with your customers.

- There are no fees to use Zelle® in the PNC Mobile App.

How It Works

Move Money in the Moment With Zelle®

Download the PNC Mobile App

Open a new account, deposit a check, check balances, make bill payments and more – all from our mobile app on your smartphone or tablet.[1] Available in English and Spanish.

(External)