During the past 20 years, credit ratings did not always matter; however, credit rating downgrades can influence available capital structure alternatives and debt capacity. Recall, for example, that during the liquidity crunch in the initial weeks following the onset of the COVID-19 pandemic, market access froze for lower-rated or spec-rated credits. Because credit agency biases affect rating reviews, healthcare organizations should consider incorporating an agency’s approach to rating reviews into their own overall strategy. Before exploring this idea in greater depth, a brief overview of rating review best practices is useful. Bear in mind that the SEC defines credit rating as an assessment of an entity’s ability to pay its financial obligations.

Rating Reviews and Best Practices

Before we focus on “recommended” factors as they apply to rating agency reviews, it is important to understand select market participants and their use of credit ratings.

- Investors use credit ratings as a tool to assess a potential investment. Investors often supplement credit ratings with their own financial analyses and research.

- Credit providers use credit ratings as a starting point for assessment of organizations’ creditworthiness. Regular, periodic review of financial results and management discussions enhance this assessment. Credit ratings may also be used as an indicator in legal documents for pricing changes, margin calls and/or termination event triggers.

- Healthcare organizations as borrowers/issuers use credit ratings as an important element in determining organizations’ ability to borrow, in terms of both access to the capital markets and direct lending from banks and other financial institutions. Credit ratings are also important in determining the cost of borrowing and, ultimately, the affordability (and feasibility) of the organization’s strategic initiatives.

In our view, the foundation for orderly financial markets rests on relationship, trust and transparency. These three factors, from our perspective, summarize a “best practice” approach to a rating agency review. For example, S&P attributes 10% of its weighting to management and governance. When it comes to achieving financial and strategic goals, management and governance may influence credibility and performance. Consequently, management and governance can be key components to building relationship, trust and transparency. Prior to the COVID-19 pandemic, S&P also cited effective management and management adaptability as key considerations that factored into its stable outlook for the healthcare sector. Currently, the S&P’s outlook on the not-for-profit healthcare sector in 2021 is negative.

Rating Strategies, Biases and Tactics

It’s important to understand that credit rating analyses are static assessments of a moment in time. Moreover, there is also a need to understand that these “snapshot” analyses are subject to certain rating agency biases, and clues to these biases are revealed in each rating agency’s outlook on the sector in a given year. For example, Fitch noted its 2021 outlook as stable, stating that the “expectation (is) that results in 2021 will be consistent with the overall weak margins in 2020.”[1] Moody’s negative outlook for 2021 could change to stable if there is operating cash flow growth between 0% and 4%.[2] In general, then, the following factors may position the healthcare sector for a robust dialog: financial flexibility, the ability to plan and manage risks, liquidity and balance sheet strength and strong cash flow generation.

Because credit ratings influence available capital structure alternatives and debt capacity, a rating strategy should fit into a healthcare organization’s overall financial strategy. An organization needs to be able to answer a question such as, “is it critical to maintain an ‘AA’ category credit rating at the expense of forgoing an acquisition of a dilutive target hospital?” The answer may depend on the reward of executing the strategy versus the market dynamics and the cost of a rating downgrade. In the last two decades, there have been prolonged periods in which credit ratings did not necessarily matter. During these periods, the differential between accessing long-term borrowings was worth only 5 bps between “AA” and “A” rating categories. Prior to the pandemic and since June 2012, credit spread differential averaged approximately 11 bps between “AA” and “A” category healthcare credits and have narrowed to as low as 5 bps during the summer of 2013.[3] However, rating downgrades can become a slippery slope, and market access can freeze periodically for lower-rated or speculative-grade credits, as was experienced in the weeks and months following the initial liquidity crunch at the onset of the COVID-19 pandemic.

An organization can implement tactical steps once it defines its rating strategy and goals. The chart below summarizes some factors to consider when preparing for rating agency reviews. The chart can also be useful for investor presentations.

| Market Environment | Market Share

Clinical Priorities

Economic Environment

|

| Healthcare Reform |

|

| Governance and Management |

|

| Financials | Balance Sheet

Capital spending plans in the near term

Operating Statement

|

How to Determine Creditworthiness

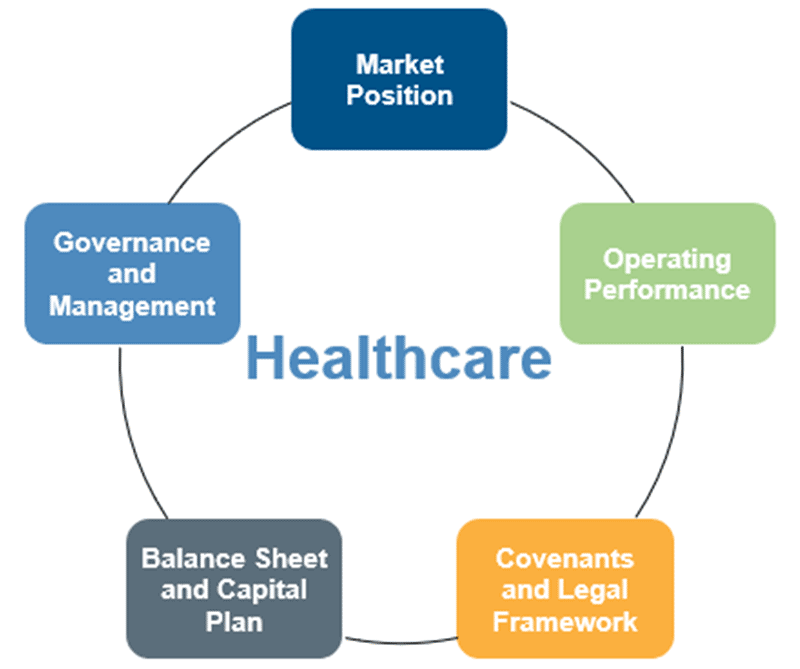

A credit rating, in a way, is a relative ranking among organizations in a sector. The quantitative assessment is completed based on how an organization compares to medians for that rating or rating category. This is supported or offset by market dynamics and strategic realities. An organization’s qualitative features, while more subjective, help rating agencies (and bond investors) understand how the organization will manage controllable factors and develop contingency plans for uncontrollable factors.

View accessible version of this chart.

An organization may also find it useful to benchmark against its peers to help articulate its position within a sub-segment or within its market. While the framework is set up such that an organization’s credit review focuses on a rating outcome, PNC believes two things are required to develop a common understanding of that organization’s creditworthiness: First, it is necessary to understand each agency’s bias toward the sector, and, second, it is necessary to articulate clearly how the organization’s rating strategy fits into its overall strategic goals.

To learn more about how we can bring ideas, insight and solutions to you, please contact your Relationship Manager or fill out a simple Contact Form and we’ll get in touch with you.

Accessible Version of Chart

Five qualitative features of a Healthcare organization that help rating agencies understand how the organization will manage controllable factors and develop contingency plans for uncontrollable factors.

2. Market Position

3. Covenants and Legal Framework

4. Balance Sheet and Capital Plan

5. Governance and Management