Trusts are used in wealth management plans to help provide financial support for family members, protect family assets from a myriad of risks, and help mitigate taxes.

Originating in English common law, trusts have been used for centuries to manage holdings of the wealthy. Even though trusts are quite common, they can be hard to understand.

A trust is a form of property ownership that separates the beneficial ownership from the legal ownership. It names a trustee as the legal owner of assets while naming one or more beneficiaries who will enjoy the benefits of the property placed in the trust. The person who created the trust and transferred ownership of assets to the trust is known as the grantor or settlor. The grantor sets the conditions and rules for usage of the property owned by the trust. The trustee carries out those directions for the benefit of the trust’s beneficiaries.

Core Concepts

The core trust assets of a trust are often referred to as trust principal or corpus. Income earned by the principal of the trust, such as dividends, interest, and rents, is called trust income. Trustees keep track of trust principal and income separately. They do this because trust income and principal often benefit different beneficiaries at different times. Also, the terms of the trust or the law governing the trust direct that certain expenses be charged to trust income and certain expenses be charged to trust principal.

Trusts create interests in property, which are generally governed by state law. Generally, if there is a connection to a state (such as the residence or headquarters of a trustee), the law of that state may govern the operation of a trust. Disputes over trust provisions and the general operation of trusts are primarily governed by state courts. As each state has different laws, the interpretation and governance of a trust can vary widely from state to state

The Revocable Trust

Trusts can be revocable or irrevocable. A revocable trust may be created by a grantor for the grantor’s own benefit during the grantor’s lifetime. It can be drafted so that it can be dissolved completely, the terms can be changed, and assets may be removed from it by the grantor without restriction. The terms of the trust document will direct the trustee as to what it may, or must, do with any property delivered to the trustee by the grantor and held in the trust. Among other things, the terms of a revocable trust will specify:

- that the grantor may amend it or revoke it completely;

- that the grantor may place additional property into the trust and request distributions from it;

- a list of administrative powers that enable the trustee to manage the trust assets; for example, to buy or sell securities; and

- what the trustee must do with the property when the grantor dies.

Generally, when a grantor transfers assets to a revocable trust for the grantor’s own benefit, there are no gift tax consequences because the grantor may revoke the trust and take the property in the trust at any time.

The gift is “incomplete” because the grantor retains control of the property in the trust.[1] For income tax purposes, the grantor is treated as owning the assets of the trust.[2]

When the grantor dies, the trustee will follow the directions in the trust with respect to the disposition of the trust’s assets. The trustee may be directed to distribute assets remaining in the trust, thereby terminating the trust, or the trust may contain provisions directing the trust to continue, how long it is to continue, and who the beneficiaries will be. If the trust continues, it becomes irrevocable because, being dead, the grantor can no longer exercise the right to revoke it.

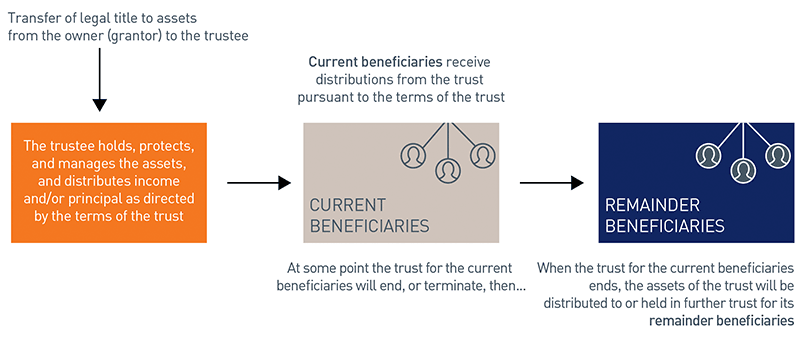

Chart 1: How Trusts Work — The Basics

View accessible version of chart 1

Common Reasons to Use a Revocable Trust

Revocable trusts are used for a number of reasons, including:

- Asset Management: A revocable trust can segregate assets and allow them to be managed separately from the grantor’s other assets.

- Protection from Incapacity: When an incapacity clause is included in the terms of the trust, the trustee (or a successor trustee if the grantor is trustee) can continue managing the assets in the trust and use those assets to care for the incapacitated grantor.

- Reduced Probate Costs and Procedures: Probate is the legal process by which a will is authenticated and given effect. In may states this can take weeks or months. Even in states where probate is relatively easy, often there are probate fees. Because the assets in a revocable trust are not owned by the deceased grantor, they do not go through the probate process and are not subject to probate fees. Further, there is no delay in managing the assets as the trustee continues (or if the grantor was trustee, a successor trustee immediately steps in) without the need of probate or a court appointment.

- Increased Privacy: Following death, a decedent’s probated will, generally, becomes a public record. Many jurisdictions do not require a revocable trust to be filed with the authority that probates wills.

- Estate Disposition: The grantor may direct the trust to continue after death for the benefit of others. A revocable trust may operate as the primary means for controlling how a grantor’s assets are distributed to heirs.

The Irrevocable Trust

The term irrevocable is often perceived literally, leading to the belief that nothing can ever be changed with respect to how the trust works and that the assets held in trust are unavailable to the trust’s beneficiaries. Although that may be the case with a trust specifically drafted to have those very strict terms, over the years trust drafting and jurisprudence regarding the administration of trusts have evolved to make irrevocable trusts somewhat flexible.

Generally, a trust is irrevocable because the grantor declares it to be so at the outset or the grantor of a revocable trust has died and no longer has the power to amend or revoke the trust. That does not necessarily mean that the terms of the trust cannot be changed. Many states have enacted statutes that allow an irrevocable trust to be changed through judicial modification (when a court changes the terms of a trust), non-judicial settlement (when the beneficiaries and trustees agree to change the terms of a trust) and decanting (when the trustee exercises a power in its discretion to distribute the trust to another trust, perhaps having different terms). Additionally, in some cases, a grantor can create a trust so that a person or group of people have the power to change the terms of the trust or to withdraw assets from the trust. (Those powers are known as “powers of appointment”.)

Most trusts will have terms that dictate when and to whom income or principal is to be distributed from the trust. Irrevocable trusts generally exist for long periods of time, years if not decades. In fact, many states now allow grantors to create perpetual trusts. For a long-term trust, the terms of the trust should take into consideration and provide the trustee with guidance for many possible and perhaps unpredictable situations. Therefore, irrevocable trusts often have extensive provisions detailing how, when, and under what circumstances the trust’s resources may be utilized by the beneficiaries. Grantors have considerable freedom to dispose of their property, which includes placing restrictions on its use, defining the terms of trusts and to whom trusts will provide benefits. Notwithstanding this freedom to dispose of property, some dispositions may have undesirable tax outcomes. Before creating a trust, you should discuss the tax consequences of its terms with your tax and legal advisors.

Common Purposes of Irrevocable Trusts

Irrevocable trusts are often created to control the ownership of assets and the use of the income from those assets. Also, irrevocable trusts are created to achieve certain desirable tax results. Often, irrevocable trusts are crafted to do both. An irrevocable trust may be created by a grantor while living, in which case it is called an inter vivos trust. It may also be created under the terms of a will, in which case it is called a testamentary trust. Some states treat the two types of trusts differently for administration and oversight purposes.

There are many types of irrevocable trusts, each with its own terms and purposes. Reviewing the many uses of irrevocable trusts is beyond the scope of this article.

Trusts can be very effective tools to protect family wealth, preserve family resources, and help maintain family financial objectives. If you would like to know more, contact any member of your PNC Private Bank team.

Irrevocable Trust Example

Lindsay decides to set aside $1 million as a safety net for each of her three young-adult children. Were she to write each of them a check, her children could spend or retain the money as they wish. Instead, Lindsay wants to be certain that her gift will be available should a child face a future financial emergency. She creates three irrevocable trusts, one for each child, all containing the following provisions:

- during the child’s lifetime, pay the child the income from the trust’s assets;

- the trustee may distribute trust principal to provide for the child’s health, education, maintenance and support.[3]

- the trustee may distribute trust principal to provide for the purchase of a home or the child’s wedding expenses;

- the child has the right to withdraw up to half of the trust principal at age 30; and

- the child may direct who will receive the assets remaining in the trust when the child dies, and if the child does not so direct, any property remaining in the trust will continue in trust (having similar terms) for each of the child’s then living children (the grantor’s grandchildren).

Common Trust Terms

Table 1: Common Trust Terms

| Term | Definition |

|---|---|

| Current Beneficiary | a person who is entitled to receive benefits from a trust at the present time. |

| Dispositive Provisions | one or more provisions of a trust directing the trustee as to how, when, and to whom to distribute trust income and principal. |

| Fiduciary | a person or entity who is entrusted to hold and manage assets for another with explicit duties of loyalty and impartiality; in the case of a trust, generally, known as the trustee. |

| Grantor | the person who created a trust, also known as the settlor or trustor. |

| Inter Vivos Trust | a trust created during the grantor’s lifetime. |

| Principal | holdings and/or investments of a trust; also called trust corpus. |

| Probate | the process by which a document purporting to be a will is validated and given effect by the appropriate governmental authority as the testator’s will. |

| Remainder Beneficiary | a person who is entitled to receive trust principal when the trust ends. |

| Testamentary Trust | a trust created under the terms of a will. |

| Trustee | a person or entity who is entrusted to hold and manage assets in a trust for others with explicit duties of loyalty and impartiality. |

| Trust Income | cash flows derived from trust assets, typically dividends, interest, and rents, but might also include such things as royalties. Capital gains are generally allocated to principal. Although capital gains may be subject to income tax, they are generally not allocated to trust income. |

For more information, please contact your PNC Private Bank advisor.

TEXT VERSION OF CHART

Chart 1: How Trusts Work —The Basics (view image of chart 1)

- Transfer of legal title to assets from the owner (grantor) to the trustee

- The trustee holds, protects, and manages the assets, and distributes income and/or principal as directed by the terms of the trust

- Current beneficiaries receive distributions from the trust pursuant to the terms of the trust

- At some point the trust for the current beneficiaries will end, or terminate, then...

- When the trust for the current beneficiaries ends, the assets of the trust will be distributed to or held in further trust for its remainder beneficiaries