Article Summary

- Bank statements are reports provided by the bank covering a specific time period, typically monthly.

- They contain important information, including the beginning and ending balance, transaction information, fees, and interest rates.

- You can access bank statements through online and mobile banking platforms or request hard copies from the bank.

- Review your bank statements once a month, looking for discrepancies, mistakes, or signs of fraud. Also, check for changes in fees and interest rates.

- If you spot an error on your bank statement, report it right away, even if it's in your favor.

Creating a budget, saving for the future, and staying out of debt are all important components of responsibly managing money. However, before doing any of these things, it’s critical to know where the money goes and how much you have. A bank statement gives a clear view of all account activity, including deposits, withdrawals, fees, and interest.

Regularly checking this document makes it easier to track spending, catch errors, and make informed financial decisions. Understanding the details on a bank statement may help keep financial goals on track.

What Is a Bank Statement?

A bank statement is an account information document provided by a bank. It summarizes the activity within an account over a specific period, typically a month. Bank statements serve as an official record of all transactions, providing account holders with a way to verify money movement into and out of the account.

Components of a Bank Statement

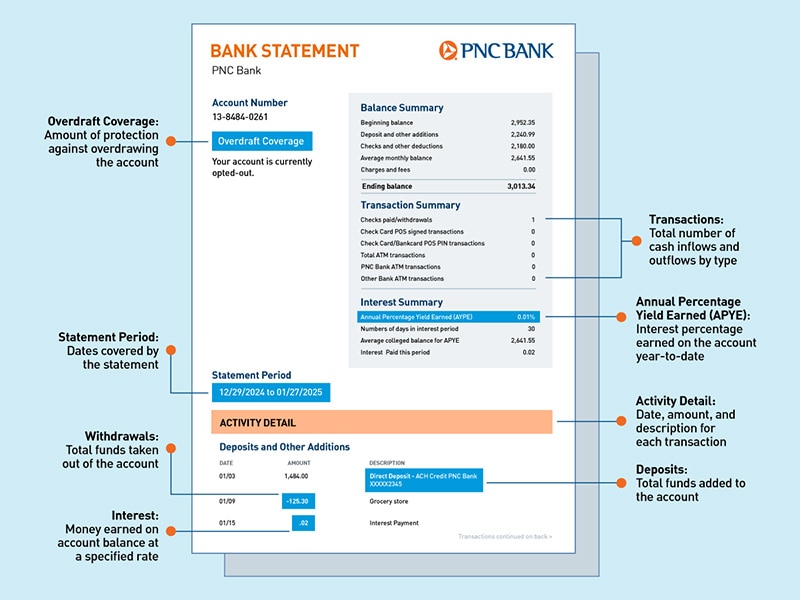

Learning how to read a bank statement starts with understanding the information contained in each section. While the exact format may differ from one bank to the next, bank statements typically provide the following information.

Account Summary

The account summary provides an overview of the account, including the account number and names of all account holders. This section may also provide details about whether the account has opted into overdraft coverage or other types of account services.

Balance Summary

The balance summary gives an overview of the account’s current financial position when the statement was generated. It includes:

- Beginning balance: Total amount of funds in the account at the start of the period

- Deposits and additions: Total amount of funds deposited into the account during the period

- Checks and deductions: Total amount of funds withdrawn from the account during the period

- Ending balance: Total amount of funds in the account at the end of the period

- Average monthly balance: Average account balance throughout the month

Unlike online and mobile banking dashboards, the balance summary on a bank statement doesn’t reflect pending transactions. It only accounts for transactions that the bank has fully processed at the end of the statement period.

Transaction Summary

The transaction summary lists the total number of transactions by type. This may include categories such as the number of checks paid and the total number of ATM transactions.

Interest Summary

For interest-bearing accounts, this section highlights any interest earned during the statement period. It shows the annual percentage yield earned (APYE), the number of days in the period, the average account balance eligible to earn the APYE, and the total interest paid during the period. PNC statements read “Average collected balance for APYE.”

Activity Detail

Activity detail provides insight into the transactions recorded during the statement period. This typically includes the date of the transaction, the amount, and a detailed description.

How To Get a Bank Statement

There are several ways to get either a hard copy or a digital version of your bank statement. Each option gives you quick access to your account details.

Online Banking Platforms

Many banks offer an online banking platform. These typically allow you to log in and access current and past bank statements, then download or print them as needed. To do this, look for the "Statements and Documents" tab. Choose the correct account and the month, then select, view, print, or download.

Physical Bank Branches

If you prefer physical statements and do not want to print them out, visit a local branch and ask for a printed statement. Some account holders prefer having statements mailed to their homes each month. However, banks may charge a small fee for both of these services. Many banks allow customers to choose paper delivery from the online or mobile platform. Other options include calling the customer service number or speaking to a bank teller.

Mobile Banking Apps

Many banks now offer mobile banking apps, making it simple to check bank statements right from a phone or tablet. This allows account holders to download, share, or review account statements on the go.

Importance of Reviewing Your Bank Statement

Regularly reviewing bank statements helps you maintain control over finances and avoid potential issues. It’s a simple habit that can make a big difference in spotting problems early and staying informed about account activity.

Identifying Errors and Discrepancies

From human error to issues with the bank's reporting system, many variables that could lead to a discrepancy between what an account holder expects and what’s reflected on a bank statement. Regular reviews may help identify double charges, forgotten transactions, and other errors that could potentially lead to overdraft fees and other problems.

Monitoring for Fraudulent Activity

Unfamiliar charges on a bank statement are sometimes a red flag for fraud. Regularly checking the statement may help catch unauthorized transactions before they get out of hand. Acting quickly makes it easier to protect an account from further damage.

Reviewing Fees and Interest Rates

Overdraft fees, charges for paper statement delivery, and other bank fees can quickly add up. Carefully reviewing each bank statement may help you identify these expenses and take steps to avoid them. Statements may also include important announcements about changes to fees or interest rates, so reading them carefully may help you stay informed.

Spotting Little-Used Subscriptions or Memberships

Bank statements are also a great way to spot recurring charges for services that are no longer needed. From gym memberships to streaming services, subscriptions can easily go unnoticed and continue draining your account. Regularly reviewing bank statements makes identifying and canceling these little-used expenses easier, freeing up funds for more important needs.

Managing Personal or Business Finances

A bank statement offers a clear view of spending habits, which is helpful for budgeting and planning. It can reveal areas where money is slipping away unnoticed, allowing for better control over personal or business finances. Regularly reviewing statements allows you to accurately track income and manage expenses.

Tips for Reviewing Bank Statements

Following a system can help make reviewing bank statements a quick and efficient process. Follow these four tips:

- Check the basics: Start by verifying that the opening and closing balances match what you expect.

- Review transactions for accuracy: Carefully read through each transaction. Watch for any unexpected charges, duplicate entries, or unfamiliar payments.

- Check for fees and interest rate changes: Review any fees or interest applied to your account. If you see anything unexpected, consider contacting the bank to discuss it.

- Establish a monthly routine: Set a specific time each month to review your statement. Pair this with other financial tasks, such as paying bills or adjusting your budget, so it becomes part of your routine.

What To Do if You Spot an Error on a Bank Statement

If you notice an error on your bank statement, it's important to act quickly. Contact the bank as soon as possible using the phone number listed on the statement. Reporting errors early may help you avoid complications. Even if the error seems to be in your favor, notify the bank immediately. Until these errors are reviewed and it has been determined that the funds are in your favor, it may be a best practice not to use any funds to help avoid additional complications.

Final Thoughts

Understanding how to read a bank statement is an essential component of managing your finances. You can access statements online or via mobile banking or visit the local branch to request hard copies. Review them regularly to help avoid errors, catch suspicious activity, and keep money management on track.

With convenient options for accessing statements and helpful customer support, PNC Bank makes it easy to take control of your money. Explore PNC Bank’s personal banking products and services today, or visit the nearest branch to learn more.