Article Summary

- A pay stub provides a breakdown of earnings, taxes, and deductions, helping to explain where your money goes.

- Regularly reviewing your pay stub ensures that all deductions and withholdings are accurate.

- Gross pay represents total earnings before deductions, while net pay is the amount received.

- Common deductions include federal and state taxes, Social Security, Medicare, and insurance premiums.

- Catching errors early, such as incorrect deductions or misreported hours, helps avoid long-term financial issues.

Have you ever been surprised by a paycheck amount that didn’t quite match expectations? From a surprise bonus to deductions for taxes or benefits, there are many variables that can affect your take-home pay. Learning how to read a pay stub makes it easier to understand exactly where that money goes, giving a clearer picture of your earnings and deductions.

Elements of a Pay Stub

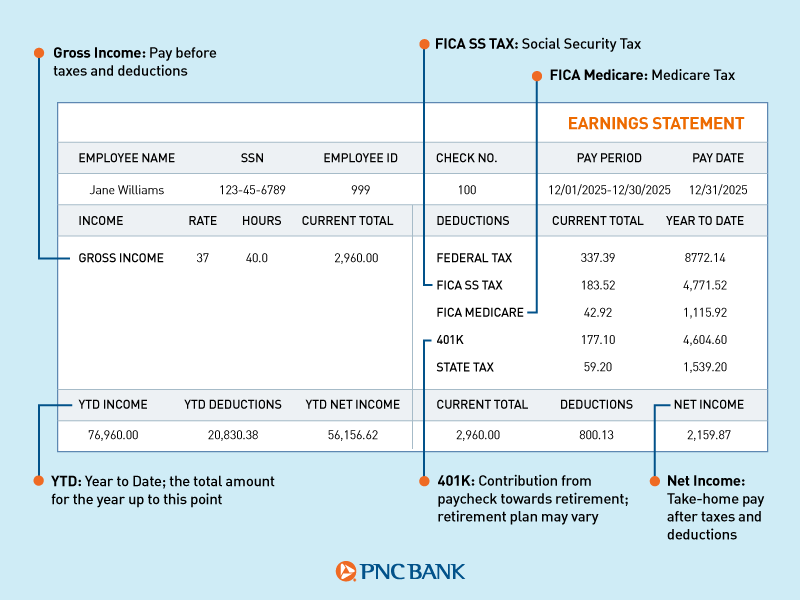

Pay stubs are divided into several sections, each providing specific information about earnings and deductions. Here’s a look at the main elements and how they affect your net pay.

Example of a Pay Stub

Employee Information

This section typically includes basic details such as the employee’s name, address, and, potentially, an employee identification number. It’s important that this information is correct, as it directly ties the paycheck to the individual. Any discrepancies in this section should be reported to human resources (HR) immediately, as they could lead to payroll issues, difficulty depositing your paycheck, or complications with tax filings.

Pay Period Dates

Pay period dates indicate the start and end of the time period reflected in the pay stub. Common pay periods include weekly, bi-weekly, or monthly. However, this varies depending on the company’s payroll schedule.

Earnings Breakdown

This section of the pay stub shows the total amount earned before any deductions. For hourly workers, this includes number of hours worked and the hourly rate. For salaried employees, it's typically the total salary for the pay period.

If you worked overtime, it will appear as well, along with the rate at which those additional hours were paid. Bonuses or commissions are also commonly reflected in this section, although this may vary depending on how they are structured within the company’s payroll system.

Total Gross Pay

The total gross pay represents the full amount earned during the pay period before any deductions or taxes. This includes regular wages, overtime, bonuses, and any additional income earned during the period. Gross pay is the baseline amount for all other calculations.

Deductions and Taxes

This section details the amounts withheld from gross pay, including mandatory taxes and optional deductions. Common deductions include:

- Federal income tax

- State and local taxes

- Social Security and Medicare (Federal Insurance Contributions Act or FICA)

- Insurance premiums

- Retirement contributions

Reviewing the deductions is key to understanding how much of your paycheck is going to taxes and benefits.

Net Pay

Net pay, also known as take-home pay, is what remains after all deductions and taxes have been subtracted from your gross pay. This is the actual amount direct deposited into your account or provided as a paycheck.

It’s important to review the net pay regularly to ensure that all deductions are accurately applied and match what’s expected. Net pay is also the amount used to create a household budget and determine how much of your paycheck you need to save.

Year-to-Date (YTD) Totals

Year-to-date totals provide a cumulative summary of all earnings, deductions, and taxes for the current year up to the most recent paycheck. These figures are useful for tracking income and tax liabilities throughout the year.

Decoding Pay Stub Deductions

Many employees find the deductions section of their paychecks confusing. It’s also one of the most important to understand, as deductions significantly affect your take-home pay. Reviewing deductions can help you clearly see what’s withheld and why. Here are some of the most common.

Federal, State, and Local Taxes

Federal and state income taxes are mandatory deductions taken from each paycheck. The federal income tax is based on your earnings and filing status. This is determined by the W-4 form you completed when hired.

State and local taxes fund government services and programs. The rates vary depending on the city and state where you work, and deductions are calculated based on your income level and tax bracket. Some states, like Florida and Texas, don’t have state income taxes. Many areas do not have local income taxes.

Social Security and Medicare

Also known as FICA taxes, Social Security and Medicare deductions are federally mandated withholdings. These deductions are used to fund the Social Security program, which provides benefits for retirees and those with disabilities. They also provide funding for the Medicare program, which helps cover healthcare costs for people aged 65 and older. Currently, employees pay 6.2% of their gross pay for Social Security and 1.45% for Medicare.[1]

Health Insurance Premiums

If an employee opts into their employer’s health insurance plan, premiums for medical, dental, or vision insurance are deducted from gross pay. These amounts vary depending on the type of plan chosen and the level of coverage. In some cases, contributions are made on a pre-tax basis, which may lower taxable income. Carefully reviewing health insurance deductions helps ensure the correct premium amount is withheld for the chosen coverage level.

Retirement Contributions

Many employees contribute to retirement savings through employer-sponsored plans, such as a 401(k) or 403(b). These contributions are typically deducted from gross pay, either on a pre-tax or post-tax basis, depending on the type of account. Employers may also match a portion of these contributions, providing an additional boost to retirement savings. Comparing the retirement contributions of the pay stub to your deduction election may help ensure accuracy.

Other Common Deductions

Several other deductions may appear on your pay stub. These might include:

- Life insurance premiums: If you have opted into an employer-provided life insurance policy, the premiums for coverage are typically deducted from the paycheck.

- Flexible spending accounts (FSA) or health savings accounts (HSA): If you have elected to participate in an FSA or HSA through payroll deductions, these funds are set aside for healthcare expenses. They are often deducted on a pre-tax basis.

- Union dues: Employees who belong to unions may see a deduction for membership dues.

- Child support or wage garnishments: In some cases, court-ordered payments, such as child support or garnishments, are deducted directly from pay and reflected in this section of the pay stub.

Common Issues and Troubleshooting

While pay stubs generally provide a detailed and accurate breakdown of earnings and deductions, errors can occasionally occur. Common issues include:

- Incorrect tax withholdings

- Missing overtime pay

- Inaccurate benefit deductions

- Misreported hours

These errors can affect your final take-home pay, so it’s important to review each pay stub carefully. Addressing errors quickly may help avoid long-term issues.

What To Do if You See Errors

If you notice a discrepancy on your pay stub, take action as soon as possible. Begin by reviewing your pay stub closely to confirm the error. Then, follow these steps:

- Review past pay stubs: Comparing the current pay stub with previous ones may help you determine whether the error is a one-time issue or part of a recurring pattern.

- Contact HR or payroll: Reach out to the human resources or payroll department to report the issue. Provide specific details about what seems incorrect, such as missing hours or incorrect tax withholdings.

- Provide documentation: If necessary, gather any supporting documents like timecards, employment contracts, or benefit forms that back up the claim. This may help expedite the resolution.

- Follow up: If the issue isn't resolved promptly, follow up with HR or payroll to ensure the correction is made in the next pay cycle.

How To Get a Copy of Your Pay Stub

Pay stubs are typically available through the employer’s payroll system. If they are not provided automatically with each paycheck, they’re often accessible through the following sources:

- Online payroll portals: Many companies offer digital access to pay stubs through an online payroll portal. Pay stubs for previous pay periods are often stored in these systems, allowing for easy retrieval.

- Request from HR or payroll department: If digital access is unavailable, contact your human resources or payroll department and request a physical or emailed copy of the pay stub. Be sure to specify the exact pay period needed.

- Mobile payroll apps: Some employers offer mobile apps connected to their payroll systems, allowing employees to access pay stubs and other payroll information on the go.

Use Your Pay Stubs To Make Informed Decisions

Each section of a pay stub offers essential insights into earnings, taxes, and deductions. Regularly reviewing your pay stubs may help you manage personal finances, catch errors early, and ensure that take-home pay is as expected.

While reading your pay stub is important, it's just one part of responsibly managing your paycheck. To make the most of your earnings, PNC Bank offers a variety of tools to help you save, spend, and plan for the future. From setting up direct deposit to building a savings strategy or managing everyday expenses, PNC has the resources to help you stay on track. Explore our banking options today.