Whether cashing a birthday check from a loved one or depositing a paycheck, the first step to turning a check into cash is endorsing it. Understanding how to endorse a check can help ensure quick, easy access to the funds.

Signing the back of a check, also known as endorsing, may seem straightforward. However, there are several important details you need to understand. The following guide explains how to endorse a check properly and safely, so you can handle the process with confidence in any situation.

Basic Steps To Endorsing A Check

Before depositing or cashing a check, you’ll typically need to endorse it. This is done by signing the back in the designated area called the endorsement box. Your signature indicates that you are the intended recipient of the funds and authorizes the bank to process the check.

While endorsing a check typically isn’t complicated, there are some important steps to follow.

1. Double-Check The Information

The first step in the check endorsement process is to double-check all of the information on the front of the check. This includes making sure your name is listed as the payee in the Pay to the Order Of section, the date and amount are correct, and the payer signed the check. If you notice any discrepancies or missing information, ask the payer to correct them before depositing the check.

2. Confirm Who Needs To Sign The Check

Next, review the payee information to confirm who needs to sign the check. When a check is made payable to an individual, the process is straightforward. However, there are times when a check is made payable to multiple parties. For example, this may occur when receiving a check as a wedding gift.

In this case, look for the words and or or on the payee line. When the word and is included, for example, Robert and Sally Smith, then both parties must endorse the check. However, if the check is written to Robert or Sally Smith, then only one of the named individuals is required to endorse the check[1].

3. Sign The Back Of The Check

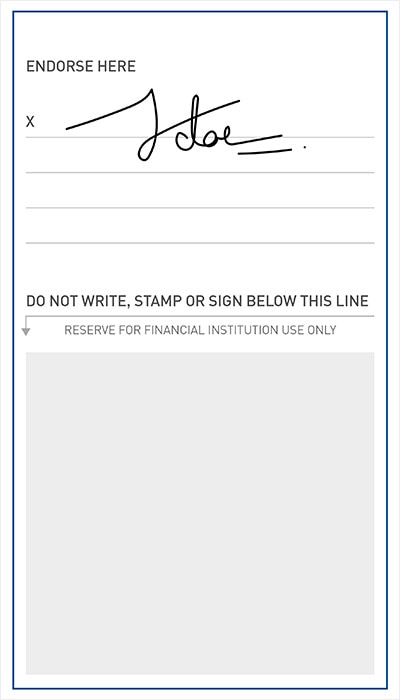

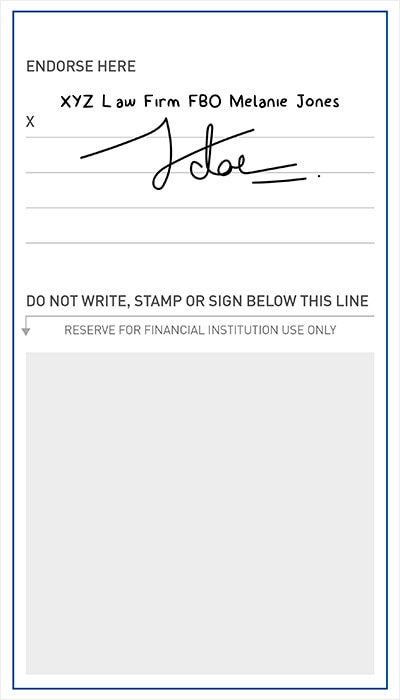

Once you've confirmed the details on the check and who needs to endorse it, it's time to sign the back of the check. Typically, you’ll find a box at the top of the check that reads Endorse Here. There are often three signature lines inside the box. Below it, there is another box that reads Do Not Write, Stamp, or Sign Below This Line.

Each required party will need to sign their name in the endorsement section. For security reasons, it’s important to use permanent ink rather than pencil or erasable ink and to sign your name exactly as it’s written on the check. If your name is spelled incorrectly on the check, sign it first with the incorrect spelling, then sign directly below with the correct spelling. Also, be sure to sign the check with the same style of signature used for your bank records. If the signature is drastically different, you may face complications with the bank cashing the check.

Following these simple steps will help you endorse a check correctly so you can avoid unnecessary complications or delays. However, the process doesn’t stop here. In the next section, we’ll discuss ways to endorse a check in various situations.

Common Ways To Endorse A Check

Understanding the basics of how to endorse a check is a great start, but you may wonder, “What do I write on the back of a check?” In some cases, you’ll simply add your signature, but other circumstances may require different types of endorsements. Here’s a look at some of the most common.

Blank Endorsement

Signing the back of a check with no other notations is known as a blank endorsement. While this is the simplest way to endorse a check, it also carries the highest risk. Once you’ve endorsed the check, it can be cashed or deposited by anyone who has it in their possession, creating a potentially serious problem if the check is lost or stolen[2]. For this reason, use a blank endorsement only when you're planning to immediately deposit or cash the check.

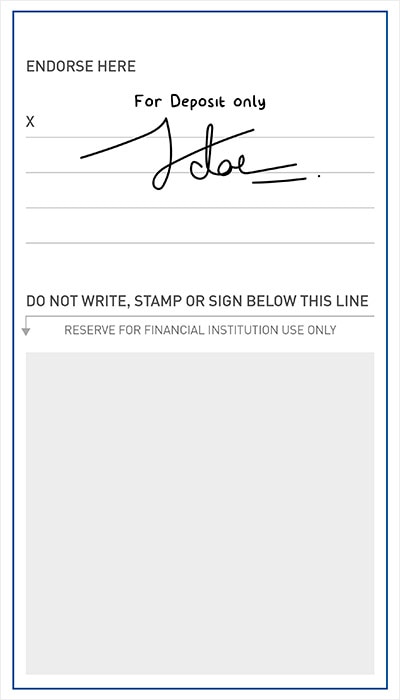

Restrictive Endorsement

Writing For Deposit Only in the endorsement box above your signature is called a restrictive endorsement. This is a more secure way to endorse checks since it ensures that the check can only be deposited into an account bearing the payee's name. You also cannot cash the check or take a portion of the amount in cash. With a For deposit only endorsement, depositing the check is the only option[3].

Once you've added your Deposit Only information, sign your name below the instructions, taking care to keep everything inside the endorsement box.

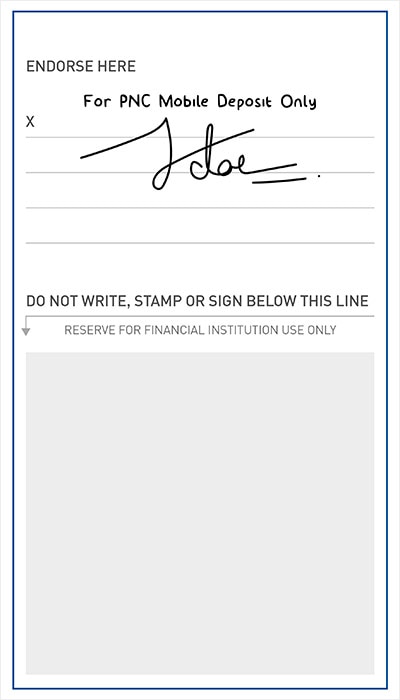

Mobile Endorsement

Online and mobile banking have become increasingly popular in recent years, making mobile check deposits more common. When depositing a check using your phone, some banks require specific wording indicating that the transaction is a mobile deposit. Others also require you to include the name of the financial institution receiving the check. For example, PNC Bank requires customers to write For PNC Mobile Deposit Only in the endorsement box above their signature.

Since each banking institution is different, it may be helpful to confirm your bank's requirements prior to endorsing a check for mobile deposit.

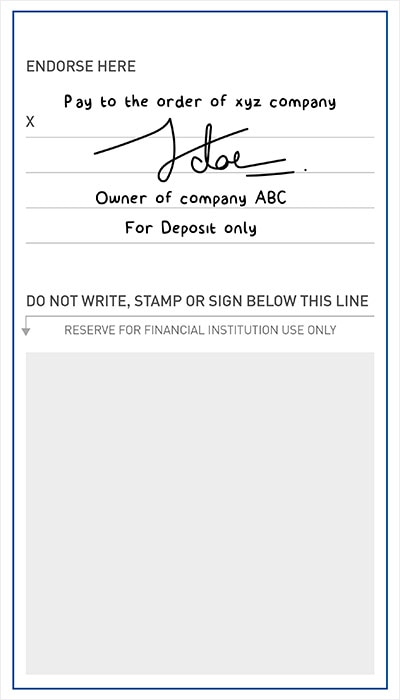

Business Endorsement

The process differs slightly when a check is made payable to a business rather than an individual. In this case, an authorized individual must endorse the check on behalf of the company. To do this, complete the following steps:

*Write the name of the business in the endorsement section, exactly as it’s written on the Pay to the Order Of line.

*Sign your name.

*Add your title (e.g., Owner, Accountant).

*Add any restrictions (e.g., For Deposit Only).

FBO (For The Benefit Of) Endorsement

Sometimes, a check is written to a third party on behalf of another person, leading you to wonder whether you can endorse a check that's not in your name. This often happens when the intended beneficiary isn't the direct recipient of the check. For example, this may occur when a legal settlement is awarded, and the check is made payable to the law firm representing the client in the case.

In this situation, the Pay to the Order Of line may look like one of the following:

*XYZ Law Firm FBO Melanie Jones

*XYZ Law Form for the Benefit of Melanie Jones

This allows the check to be cashed by the law firm but indicates that the funds are for the benefit of the client, creating a clear paper trail. The law firm isn't the final beneficiary — the client is. However, FBO checks must be endorsed by the first payee written on the Pay to the Order Of line. In this case, a representative of the law firm would need to endorse the check.

It's important to note that some institutions require both parties to endorse an FBO check, which can be a problem if the person benefitting from the check is a minor or incapacitated. If this situation occurs, you may need to consult with the bank about how to handle the issue.

Final Thoughts On Check Endorsements

A check endorsement is more than just a signature, it’s also a security feature. Signing the back of the check validates it and helps ensure the funds are distributed correctly. Whether you're dealing with a standard check, navigating a unique situation, or simply want to ensure the safest process, these check endorsement guidelines will prepare you for success.

If you're seeking a banking partner that prioritizes convenience and security, consider exploring PNC Bank's checking options. Our customer service team is always ready to assist you with any questions or concerns regarding check endorsements or any other banking needs.