A medida que las organizaciones de atención médica continúan enfrentando un entorno empresarial volátil, un programa de inversión diseñado cuidadosamente puede ofrecer una fuente de estabilidad. En esta publicación, analizamos cinco áreas clave para ayudar a su organización a desarrollar su estrategia de inversión y prepararse para lo que se avecina en 2025.

1. Establecer la resiliencia de la liquidez y el capital para las épocas de incertidumbre

Considerando el entorno económico incierto que se avecina, la resiliencia de la liquidez y el capital es fundamental. Las organizaciones de atención médica deben considerar evaluar sus estructuras de liquidez para prepararse para las posibles fluctuaciones de los ingresos y los cambios legislativos en 2025.

Implementar o determinar una estructura de grupo de inversión escalonados

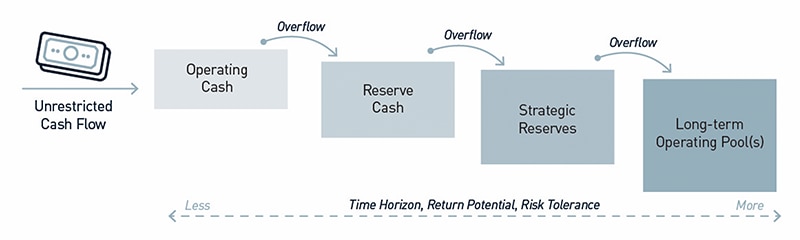

Los grupos de activos escalonados pueden ayudar a las organizaciones a mantener la liquidez durante los períodos de volatilidad, mientras continúan beneficiándose del crecimiento de los activos a largo plazo. Un ejemplo es la estructura del grupo operativo, de reserva, estratégico y a largo plazo que se muestra en la Figura 1.

Figura 1. Estructura de grupo de inversión escalonado.

Fuente: PNC. Para fines ilustrativos únicamente.

Ver la versión accesible de este gráfico.

- Efectivo operativo: El efectivo necesario para respaldar las operaciones continuas. A menudo los fondos se mantienen en cuentas bancarias o cuentas sweep money market.

- Efectivo de reserva y reservas estratégicas: El efectivo paga gastos imprevistos de monto elevado o desembolsos de capital a corto plazo. Estos fondos también pueden servir como una “reserva” para las carteras de inversión, con la posibilidad de proteger estos fondos para evitar su uso para cubrir necesidades operativas a corto plazo. Los fondos se pueden invertir en títulos de renta fija a corto plazo para generar un retorno adicional al mismo tiempo que se conserva la liquidez.

- Fondos a largo plazo: Los activos de inversión destinados a preservar la solidez financiera de la organización, aumentar el número de días de efectivo en mano y contribuir a su misión y objetivos estratégicos. Los fondos por lo general se invierten en carteras de acciones de múltiples activos, renta fija y alternativas.

Conclusión principal: Las organizaciones de atención médica a menudo experimentan flujos de caja variables debido a la demanda de los pacientes, los costos elevados, los cambios regulatorios y la presión ejercida por los reembolsos. Un sólido plan de resiliencia de liquidez y capital puede permitir que las organizaciones de atención médica cumplan las demandas imprevistas sin alterar sus metas de inversión a largo plazo. Tener una estructura que priorice la liquidez durante los períodos de tensión operativa es fundamental para navegar los entornos impredecibles.

2. Adaptarse a la caída de las tasas de interés y al impacto que estas tienen en los grupos de inversión

Considerando que las expectativas del mercado están fijando los precios según la normalización continua de la curva de rendimiento, los sistemas de atención médica quizás deban reevaluar el potencial de retorno de sus carteras y adaptarse a la dinámica cambiante de los mercados de renta fija.

Se prevé que los rendimientos de efectivo disminuyan rápidamente en 2025

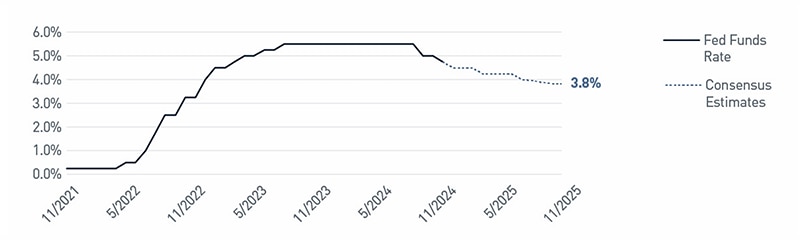

A medida que la Reserva Federal (Fed) flexibiliza la política monetaria mediante la reducción de las tasas de interés, las condiciones financieras deben continuar relajándose. Por lo tanto, se prevé que los rendimientos de efectivo disminuyan de forma significativa durante el próximo año, como se muestra en la Figura 2.

Figura 2. Se prevé que los rendimientos de efectivo disminuyan rápidamente en 2025.

A partir del 11/30/2024. Fuente: Bloomberg L.P.

Consulte la versión accesible de esta tabla.

Navegar el descenso de las tasas de depósito

- Es posible que los depósitos que generan intereses y los rendimientos de los fondos money market (MMF), de los que muchos sistemas de atención médica dependen para tener liquidez, sigan disminuyendo a medida que la Fed flexibiliza la política. Para el efectivo operativo excedente, considere estrategias alternativas de renta fija de corta duración que puedan ayudar a mejorar el rendimiento y generar diversificación y oportunidades de retorno total, sin poner en riesgo la liquidez.

- Las tasas de interés más bajas afectan directamente a los planes de beneficios definidos al aumentar el valor presente de los pasivos de los planes. Sin una estrategia de inversión meditada, esto probablemente genere la disminución de la relación de financiamiento del plan. Las organizaciones de atención médica que patrocinan planes de beneficios definidos deben considerar trabajar con sus administradores de inversiones para evaluar las mejores estrategias de inversión basadas en pasivos para un entorno de tasas bajas, a fin de tener la posibilidad de blindarse contra los futuros cambios de las tasas de interés.

- Para los emisores de deuda pública en años recientes, los fondos money market han proporcionado un lugar atractivo para invertir los ingresos reservados para gastos de capital. A medida que la curva de rendimiento continúa normalizándose, pueden surgir oportunidades para dejar de conservar las ganancias de los bonos en fondos money market para invertirlos en carteras de bonos escalonadas de contrapartida de flujo de caja. Una cartera de bonos escalonada que coincida con las necesidades de gastos de capital previstos puede ayudar a su organización a captar mayores rendimientos y brindar protección en un entorno de tasas de interés decrecientes.

Conclusión principal: Un entorno de tasas de interés más bajas requiere que el sistema de atención médica reinvente las estrategias de renta fija, centrándose tanto en la mejora del rendimiento como en la administración del pasivo. Trabajar en estrecha colaboración con asesores de inversión para optimizar estas áreas puede brindar tanto rendimiento como un contrapeso.

3. El ascenso de la inteligencia artificial (IA) y la tecnología en la administración de inversiones

La IA y demás avances tecnológicos están modificando el panorama de las inversiones y, a su vez, pueden presentar oportunidades de negocios e inversión para las organizaciones de atención médica. Los análisis predictivos basados en IA pueden ofrecer perspectivas profundas con respecto a las tendencias del mercado y ayudar a los inversionistas de atención médica a tomar decisiones más informadas basadas en datos. Además de los análisis, existe un gran número de inversiones de capital de riesgo y capital privado que se centran en compañías de IA, en particular las que promueven las tecnologías de atención médica.

Conclusión principal: Considere adoptar la IA no solo como una herramienta para la toma de decisiones, sino también como una posible área de distribución de capital. Debido a que su presencia en el sector de atención médica continúa creciendo, las organizaciones de atención médica deben evaluar maneras para mantenerse a la vanguardia en cuanto a la forma en la que aprovechan el poder de la IA.

4. Tomar un enfoque estratégico a las alternativas

En un entorno de mercado complicado, las inversiones alternativas pueden ofrecer diversificación para sus carteras de atención médica. Muchos inversionistas de atención médica continúan analizando alternativas, como los activos reales, el capital privado y las inversiones basadas en misiones para cumplir sus objetivos particulares.

- Mientras persisten las preocupaciones por la inflación, los activos reales, como la infraestructura o los bienes raíces, pueden brindar una ventaja. Los sistemas de atención médica que invierten en dichos activos pueden obtener beneficios desde la perspectiva de los ingresos como desde la perspectiva de la protección contra la inflación.

- Las alternativas como el capital privado y el crédito privado permiten la diversificación más allá de los mercados públicos, lo que integra un menor número de fuentes de retorno correlacionadas. Para los sistemas de atención médica, estas inversiones pueden generar beneficios financieros que respaldan el crecimiento y la estabilidad operativa.

- El capital de riesgo centrado en la atención médica y las inversiones directas en compañías de fase inicial pueden ofrecer un retorno de inversión positivo al mismo tiempo que apoya la innovación impactante. Invertir en la tecnología que impulsará el futuro de la atención médica puede servir como un activo tanto financiero como estratégico.

- La inversión con propósito ha adquirido una mayor popularidad en las organizaciones de atención médica. Alinear las carteras de inversión con la misión de una organización de atención médica puede reforzar el compromiso que esta tiene con la comunidad y la sostenibilidad. Debido a la demanda creciente de la alineación de la misión, los inversionistas de atención médica han adoptado oportunidades de inversión alternativas que tienen la finalidad de ayudar a que coincidan con la misión de la organización.

Conclusión principal: Evaluar el uso de alternativas en la cartera de su organización ya no es solo una cuestión de retornos, sino que además puede ayudar a brindar protección contra la volatilidad del mercado y aumentar el impacto en la comunidad. Las inversiones alternativas que se alinean con las metas de una organización pueden ayudar a reforzar los objetivos financieros y los objetivos de la misión del sistema.

5. Reinventar el compromiso de los asesores

Los asesores de inversión ya no son solo encargados de asignación de activos, sino que pueden ser socios estratégicos que añaden valor más allá de la administración de la cartera tradicional. Para las organizaciones de atención médica, el mayor compromiso que tienen con sus asesores y administradores de inversiones puede dar lugar a soluciones más personalizadas a fin de satisfacer las diferentes necesidades de los sistemas de salud, sus emisores de seguros cautivos y sus planes de beneficios definidos.

Considere si hay servicios mejorados que su asesor de inversiones pueda ofrecer a su organización. Por ejemplo, pídale a su administrador que modele decisiones de inversión para comprender mejor el impacto que las decisiones de inversión tienen en las métricas del balance general y los convenios de deudas (p. ej., días de efectivo en mano, relación de cobertura de servicios de deuda, etc.). Esto puede ilustrar si el nivel de riesgo de su organización es adecuado, así como ayudar a alinear las inversiones con las metas financieras generales. De manera similar, en un entorno en el que los pasivos están cambiando constantemente, las revisiones regulares de las estrategias de equiparación de activos y pasivos pueden proteger la idoneidad del financiamiento para las reclamaciones y obligaciones de pensiones futuras.

Conclusión principal: Forje relaciones con asesores de inversión y administradores que comprendan las complejidades del financiamiento de atención médica y puedan aportar un enfoque consultivo. Al hacerlo, su organización puede ser más ágil al responder a los desafíos financieros al mismo tiempo que mantiene la alineación con los objetivos generales de la misión e impulsa la administración del riesgo.

Navegar un entorno de atención médica complejo y en constante cambio

Prepare su organización para la incertidumbre económica, los avances tecnológicos y las expectativas cambiantes. Al fortalecer la liquidez, adaptándose a tasas de interés más bajas, hacer uso de la tecnología, evaluar el uso de las alternativas y reinventar el compromiso de los socios de inversión, las organizaciones de atención médica pueden preparar sus carteras para la resiliencia y el crecimiento en 2025 y a futuro. Las estrategias de inversión adecuadas no solo pueden fortalecer el balance general de su organización, sino que además pueden apoyar su enfoque fundamental en la entrega de servicios básicos de atención médica en nuestras comunidades.

Versión accesible de los gráficos

Gráfico 1. Estructura de grupo de inversión escalonado (ver imagen)

En una estructura de grupo de inversión escalonado, el efectivo sin restricciones desborda los flujos hacia diferentes grupos, cada uno de los cuales tiene un plazo previsto subsecuentemente más largo, un potencial de retorno más alto y una tolerancia al riesgo más alta que el grupo anterior. En este ejemplo, el efectivo se desplaza en cuatro grupos: efectivo operativo, efectivo de reserva, reservas estratégicas y, por último, grupos operativos a largo plazo.

Fuente: PNC. Para fines ilustrativos únicamente.

Figura 2. Se prevé que los rendimientos de efectivo disminuyan rápidamente en 2025 (ver imagen)

|

Tasa de fondos federales |

Estimaciones de consenso |

11/2021 |

0.3 % |

|

5/2022 |

1.0 % |

|

11/2022 |

4.0 % |

|

5/2023 |

5.3% |

|

11/2024 |

4.8% |

|

5/2025 |

|

4.0 % |

11/2025 |

|

3.4% |

A partir del 11/30/2024. Fuente: Bloomberg L.P.