Year to year, philanthropic giving is shaped by a variety of influences, including economic changes, tax and policy shifts, and social movements, to name a few. Understanding the current giving landscape can help nonprofit organizations inform their fundraising strategies, allowing them to better financially prepare for both the short and long term.

Top Trends

Overall giving is down

In 2023, total giving reached $557.16 billion, which represented a 2.1% decrease (adjusted for inflation) from 2022, and total giving in 2022 was down 10.5% from 2021.

Fewer donors, larger gifts

In 2023, individual charitable giving came from fewer sources. Mega gifts from ultra-high-net-worth donors continued to increase ($2.24 billion in 2023, compared to $1.08 billion in 2022), but the total number of donors decreased.

Shift in giving vehicles

Donor-advised fund (DAF) giving reached an all-time high in 2022. Qualified charitable distributions (QCD) and charitable remainder trusts (CRT) also gained in popularity as donors capitalized on the tax benefit opportunities

Who is Giving?

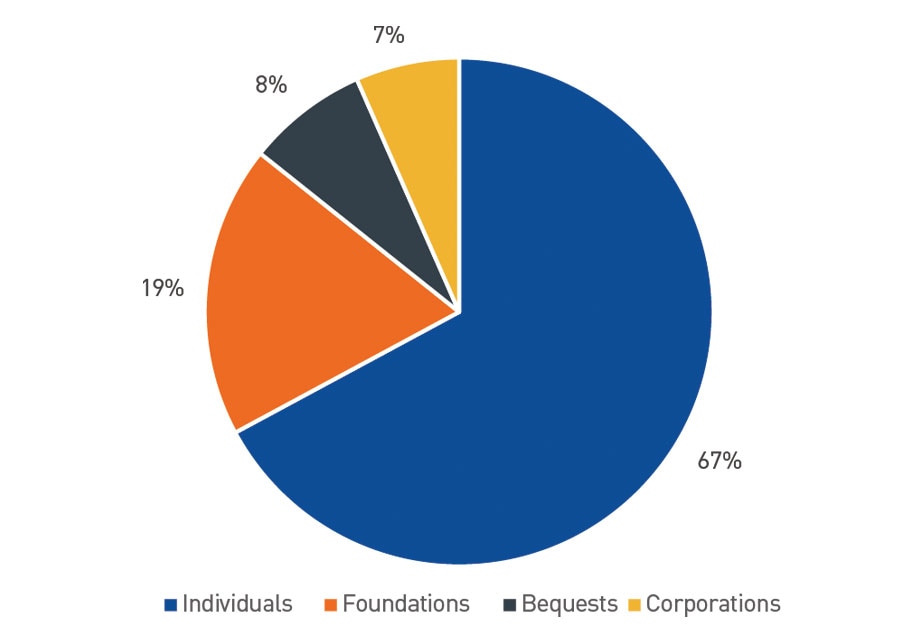

The majority of charitable donations were made by individuals and foundations in 2023 (Figure 1).

Figure 1: 2024 Source of Contributions

Source: Giving USA 2024

Following 2022, where markets experienced declines last seen during the Great Financial Crisis, the S&P 500® returned 24.2% in 2023. The economic and geopolitical concerns that fueled market turbulence in 2022 largely continued into 2023, while returns improved, the economic uncertainty and market volatility created headwinds for philanthropy.

Foundation giving increased 1.7%, a 2.3% decrease when adjusted for inflation from the prior year. As foundation giving is often impacted by the market performance of the prior year, the decrease is not terribly surprising given the negative impact of 2022 returns. Foundations are well positioned to increase giving in 2024 and 2025, due to strong market performance of 2023. Foundation assets hit a record high of $1.5 trillion, growing at an annualized average rate of 8.3%.

While corporate giving declined 1.1% on an inflationadjusted basis in 2023, in current dollars, corporate giving grew 3.0% due to an increase in corporate pretax profits and strong U.S. GDP growth.

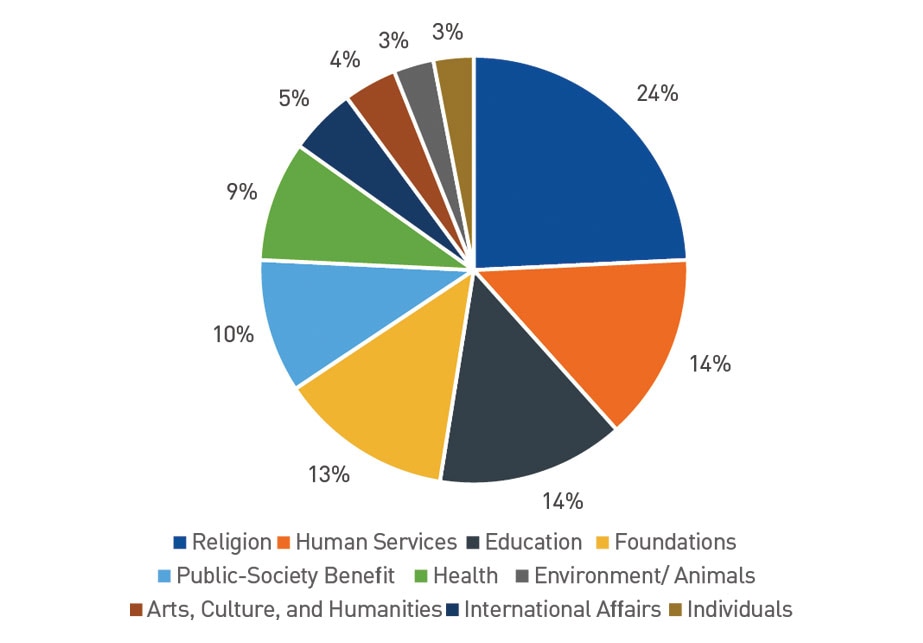

Who is receiving gifts?

From year to year, there are shifts in giving to different categories of causes. Understanding these shifts can help organizations get a sense of donor sentiment related to their cause area. Over the past few years, events like the global COVID-19 pandemic, geopolitical disruption and the effects of inflation on community need have influenced where charitable dollars have been directed. In 2023, religious-oriented organizations continued to receive the largest share of total contributions, followed by human services and education-related organizations (Figure 2).

Figure 2: 2024 Share of contributions

Source: Giving USA 2024

From 2022 to 2023, the biggest changes included giving to individuals, which saw a 17.2% decrease in 2023, and giving to arts, culture and humanities, public-society benefit and education, which all saw increases of 11% or more.

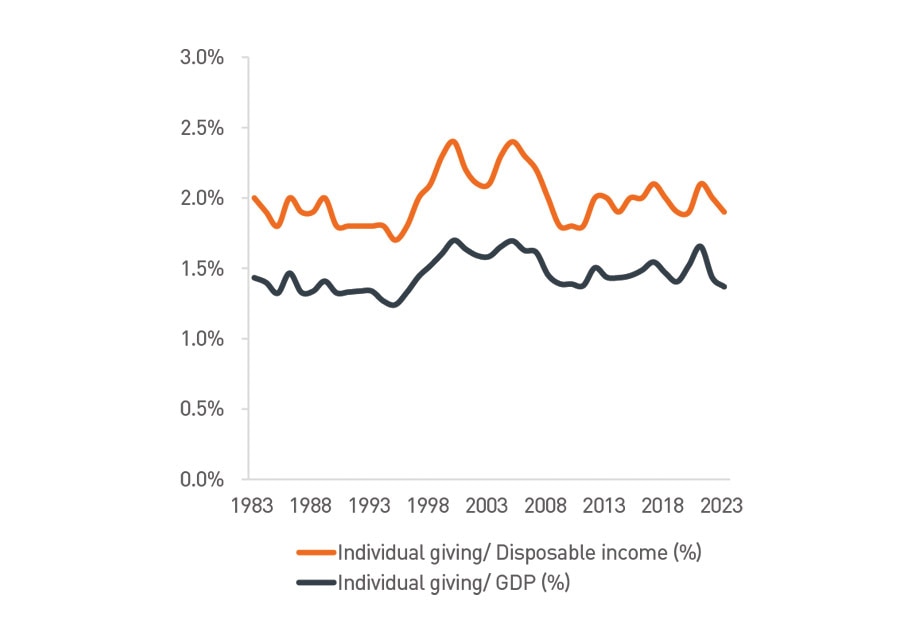

How did economic indicators inform charitable giving?

Economic factors impact charitable giving, particularly from individuals – a favorable economy is a favorable philanthropic environment. While GDP and stock market growth created a beneficial giving environment in 2023, it followed a turbulent market in 2022, and has come in a macro environment characterized by above-average inflation and elevated interest rates. In 2022, U.S. inflation hit a 40-year high at 9.1%, prompting 11 rate hikes by the Federal Reserve between March 2022 and July 2023.

These factors created financial uncertainty for individuals and households, which led to a decrease in individual giving as a percentage of disposable income and as a percentage of GDP (Figure 3).

Figure 3: Individual giving Recipients of Investment Program Distributions

Source: Giving USA 2024

How donors give

While economic and social factors impact philanthropy, nonprofits can take measures to bolster fundraising practices. Nonprofits might consider the ways donors like to give and incorporate untapped strategies into donor education efforts.

For example, there is an estimated $72 trillion in assets expected to pass between generations over the next 25 years, and most of that wealth is held in noncash assets like securities, real estate, art and other tangibles. Nonprofits should make themselves aware of the most popular giving vehicles, as well as those that are growing in popularity, to establish the processes and policies that support making it easy for donors to give. Now is a good time for nonprofits to revisit their gift acceptance policy, as well as the language on their donate page, to make it clear what giving strategies they can accommodate.

Donor-advised funds reach all-time high

Contributions to DAFs reached an all-time high in 2022, with a 9% increase from FY2021 and FY2022. Similarly, distributions from DAFs totaled $52.16 billion in 2022, a 9.1% year-over-year increase.

Qualified charitable distributions rise in popularity

The SECURE Act 2.0 passed in December 2022, included the Legacy IRA Act, which expanded qualified charitable distributions to include funding split interest charitable remainder trusts (CRTs) and charitable gift annuities (CGAs), ultimately increasing the opportunity for donors to give. Popularity for both types of QCDs has grown, primarily due to increased awareness through marketing and education efforts.

QCDs can allow individuals to reduce their taxable income in years in which they must make required distributions from their IRA accounts, providing a tax advantageous way to give. Nonprofits may want to ask their qualifying donors about their experience with QCDs and consider soliciting these gifts, particularly around year-end, when individuals must meet required minimum distribution deadlines.

What was the impact of government policy on donor giving?

Factors like government policy, regulatory intervention, including monetary and fiscal stimulus can impact when, and to what level, donors choose to give. While most donors’ primary motivation for contributing to nonprofits is not financial gain, nonprofits have historically benefitted from increased giving when donors are incentivized to give, for example, through tax policy.

By receiving a tax deduction for charitable donations, donors are often able to reduce their adjusted gross income (AGI) and avoid paying capital gains tax when they donate appreciated securities. The introduction of the CARES Act in 2020 provided an example of this type of incentivizing tax policy. The Act was extended into 2021 and allowed itemizing taxpayers to receive a deduction of up to 100% of AGI for cash contributions (formerly 60 percent prior to the CARES Act). Nonitemizers who take the standard tax deduction could deduct up to $300 if filing an individual return, and up to $600 for those who are married filing jointly. However, these provisions expired in 2022, spurring new proposals to change the tax code to incentivize charitable giving more permanently.

In February 2023, the Charitable Act was introduced in the Senate to establish a universal charitable deduction. The bill, which has bipartisan support, would reinstate the allowance of non-itemizers to deduct charitable donations from their adjusted gross income.

The tax code provisions established by the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire end of 2025, and charities and donors alike are monitoring whether those will be renewed or replaced. One of the provisions includes the charitable deduction limit; with the expiration of TCJA, the charitable deduction amount would be reduced from 60% of adjusted gross income for cash donations, to the prior amount of 50%.

Nonprofit leaders should be aware of other potential legislative and regulatory impacts, such as the IRSproposed donor-advised fund rules, the “SEAT” Act and others. Aside from legal counsel and tax advisors, state nonprofit associations can be an excellent resource to help stay informed of regulatory changes and their impacts to nonprofits.

Conclusion

In our view, there are several positive indicators for charitable giving in the coming years, particularly as elevated inflation begins to taper off and investment market performance continues to yield positive returns. Nonprofits can rely on the partners in their network, including their investment advisor, to understand the headwinds and tailwinds facing philanthropy.

TEXT VERSION OF CHARTS

Figure 1: Source of contributions (view image)

Individuals |

67% |

Foundations |

19% |

Bequests |

8% |

Corporations |

7% |

Source: Giving USA 2024

Figure 2: Share of contributions (view image)

Religion |

24% |

Human Services |

14% |

Education |

14% |

Foundations |

13% |

Public-Society Benefit |

10% |

Health |

9% |

International Affairs |

5% |

Arts, Culture, and Humanities |

4% |

Environment/ Animals |

3% |

Individuals |

3% |

Figure 3: Individual giving as a percentage of disposable income (view image)

Year |

Individual giving (current dollars) |

Individual giving/ Disposable income (%) |

GDP (current dollars) |

Individual giving/ GDP (%) |

1983 |

$52.06 |

2.0% |

$3,634 |

1.43% |

1988 |

$69.98 |

1.9% |

$5,236 |

1.34% |

1993 |

$91.72 |

1.8% |

$6,859 |

1.34% |

1998 |

$137.68 |

2.1% |

$9,063 |

1.52% |

2003 |

$181.47 |

2.1% |

$11,458 |

1.58% |

2008 |

$213.76 |

2.0% |

$14,713 |

1.45% |

2013 |

$242.43 |

2.0% |

$16,881 |

1.44% |

2018 |

$302.80 |

2.0% |

$20,657 |

1.47% |

2023 |

$374.40 |

1.9% |

$27,361 |

1.37% |

Source: Giving USA 2024