The US Navy SEALS, famous for their work ethic, have a motto: “The only easy day was yesterday.” Implicit in this motto is both the recognition that things don’t necessarily get easier with time and the commitment to rising to the challenge that each new day brings. While the day-to-day responsibilities might be different, the board members and leadership of nonprofit organizations face a similarly evolving landscape of challenges, including unpredictable markets, complex regulatory requirements, and increased need from the communities, constituencies, and missions they serve, to name a few.

In this paper, we discuss five best practices nonprofit boards and their members can implement to meet these challenges. Specifically, we address investment program governance; continuing education for investments; continuing education beyond investments; diversity, equity, and inclusion focus at the board, management, and volunteer levels; and board succession planning.

1. Investment Program Governance

If you asked the boards and investment committees of nonprofit organizations what aspects of the investment program are most important to creating success in reaching goals and objectives, how many do you think would put “governance and oversight” into their top three?

In our experience, the most common answers we hear include asset allocation, manager selection, risk management, and other aspects of the investment process. On the other hand, answers relating to the investment philosophy, such as governance and oversight, setting goals and objectives, and maintaining strategic continuity across board or decision-maker succession, tend to be significantly less frequent.

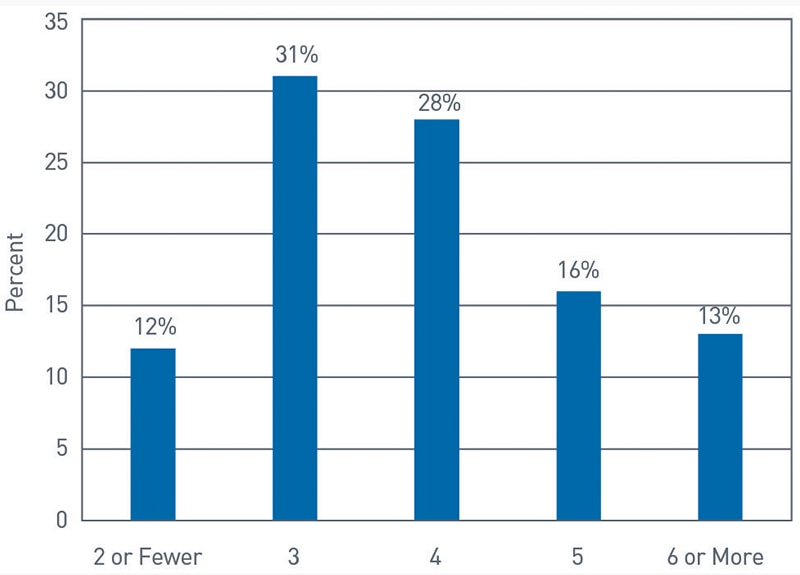

We asked 188 nonprofit organizations the question, “Including yourself, how many individuals play an active role in overseeing your organization’s investment portfolio?”[1] The majority of respondents (59%) responded with 3 or 4 individuals. This would seem to suggest that despite boards often averaging 10 members (in our experience), not all members are actively engaged in overseeing the investment program.

How Many Individuals Play an Active Role in Overseeing Your Organization’s Investment Portfolio?

Source: PNC

View accessible version of this chart.

While some of this might be a case of “those with the most experience with investments form a special investment committee,” we believe one of the most important jobs of a board is to establish governance and oversight of the investment program. This means documenting in an investment policy statement the responsibilities of the board, investment committee, and other decision makers, including reviewing the portfolio’s performance against objectives; examining guidelines for making decisions around hiring, retaining, and terminating investment managers; determining how often the investment strategy will be reviewed; and more.

For more information on the importance of board governance in managing a nonprofit investment program, please see our white paper Governance and Oversight: Essential Components of a Successful Investment Program.

2. Continuing Education for Investments

In our investment philosophy at PNC Institutional Asset Management®, we start by stating:

Markets can be inefficient, and investment opportunities are ever changing. A thorough understanding of the past, combined with rigorous analysis of the present, offers insight into the most probable path forward.

At its core, our investment philosophy focuses on the idea that an investor should be a “Student of the Markets,” constantly striving to learn and grow in understanding the investment markets.

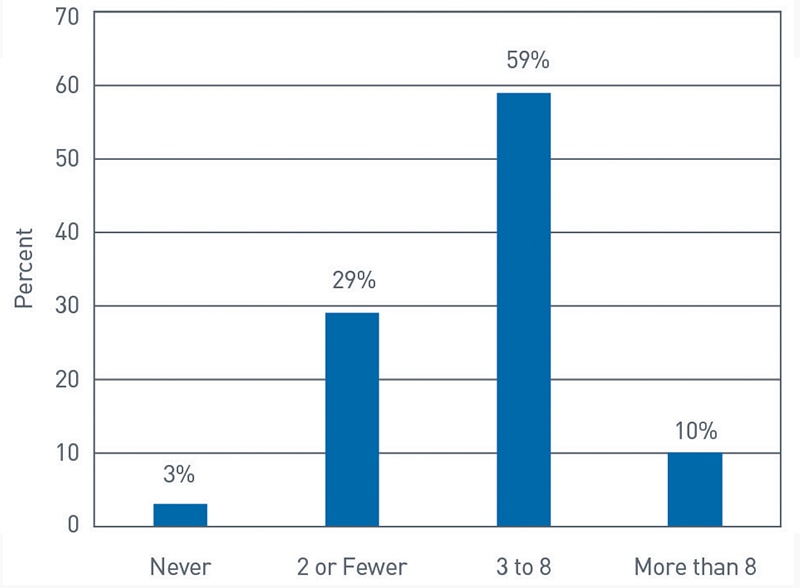

In a 2020 survey of nonprofit organizations, we asked two questions:[1]

- In the past two years, how many times have financial decision makers at your organization engaged in formal, external education regarding nonprofit best practices?” (n = 188)

- What educational topics were covered in the past two years? (n = 183)

Source: PNC; numbers may not total 100% due to rounding.

View accessible version of this chart.

What Educational Topics were Covered in the Past Two Years?

Source: PNC; numbers may not total 100% due to rounding.

View accessible version of this chart.

The key takeaways from these questions is that the majority of nonprofit organizations (69%) are engaging in three or more educational sessions on nonprofit best practices, with 85% of those focusing on investment-related topics.

In our experience working with nonprofit clients, this practice of continuing education on investments (even in outsourced chief investment officer relationships where the investment manager has discretion for the investment portfolio) helps the investment manager and the asset owner (the nonprofit organization) to “be on the same page.” Breaking it down:

- The board (and the investment program) benefits from a better understanding of their investments, leading to more effective oversight.

- The investment manager is better able to convey the reasoning and rationale behind current investment strategy and future recommendations, reducing potential friction between asset owner and asset manager.

In combination, we believe this can lead to better outcomes for nonprofit investment programs.

3. Continuing Education Beyond Investments

While the previous best practice focused on better outcomes for nonprofit investment programs, this one focuses on improving outcomes for nonprofit enterprises.By nonprofit enterprise, we are referring to the nonprofit organization as a whole. Specifically, how everything from generating financial assets to operational effectiveness and minimizing expenses relates to the overall success of the nonprofit in reaching its mission or objectives. The answers fundraising, board governance, borrowing/financing, and mission- specific go to this idea that the leadership of nonprofit organizations can be “students of nonprofits” as much as they are “students of the markets.”

While it is easy to understand the importance of staying on top of nonprofit best practices and related education, the survey results provide evidence that almost one in three board members do not receive any education on these types of topics.

Improving these numbers and actively engaging in continuing education beyond investments could be beneficial to nonprofit leadership, especially for board members who might not be involved in the day-to-day operations of running a nonprofit organization. Further, education is readily available and often free. As an example, our PNC Endowment & Foundation National Practice Group creates free thought leadership, educational events, and webinars for nonprofit organizations. There are also a number of nonprofit associations, news organizations, and other sources providing free (and paid) educational content for nonprofit leadership.

Committing to education is easy: Set an expectation that board members and/or management try to attend a minimum number of these types of educational events/webinars, read a minimum number of papers or other thought leadership, or other measurable, clearly defined continuing education goals. We find that many organizations commit to this continuing education together, usually as part of the agenda in board meetings. In this way, the group is able to work and learn together, allowing it to also serve as a team-building exercise.

4. Diversity, Equity, and Inclusion

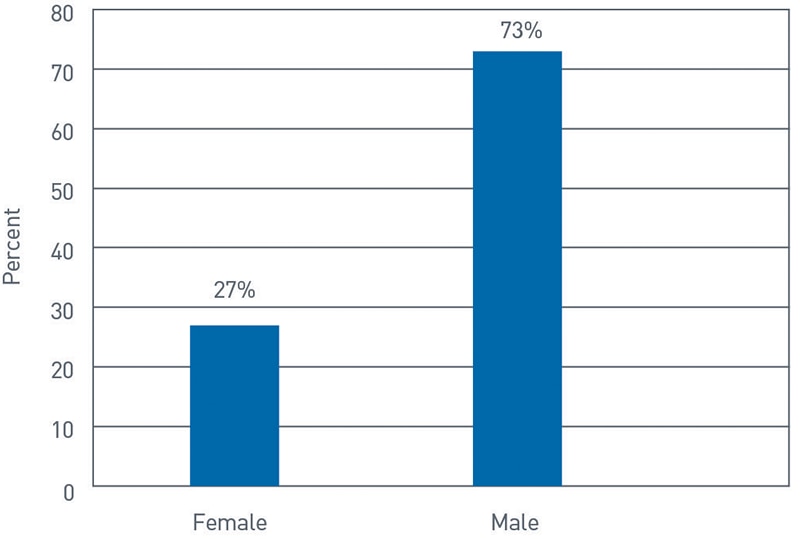

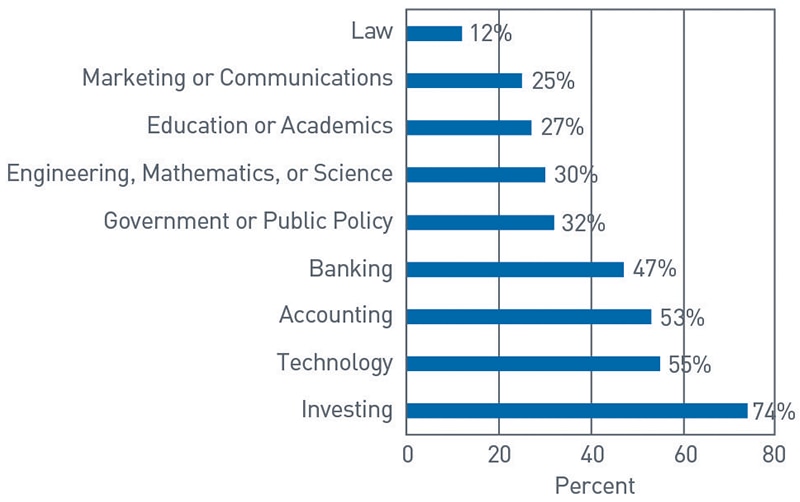

There are many studies and research that establish and support that diversity, equity, and inclusion (DEI) improve outcomes for nonprofit and for-profit organizations alike. When we say DEI, many people default to thinking in terms of race or even religion; however, true DEI spans a number of different demographic considerations, in our opinion. Building a diverse and inclusive team of individuals across an expansive set of demographic factors, expanding from race and gender to include things such as age, sexual orientation, education and/or experience, and even geographic background can help organizations to increase the likelihood of succeeding while avoiding many of the pitfalls that can come from a group of like-minded individuals engaging in a vacuum (or groupthink). We asked two questions related to this topic to nonprofit organizations in a 2020 survey (n=188):[1]

- Are you…?

- In which of the following areas do you feel you have expertise?

Source: PNC

View accessible version of this chart.

In which of the following areas do you feel you have expertise?

Source: PNC

View accessible version of this chart.

These data might come as no surprise to many: Women are very much underrepresented on boards relative to their percentage of the population, and investing, finance, and accounting related-backgrounds are highly represented.

This same exercise in understanding the demographic makeup of nonprofit leadership could likely be done for a number of different factors and end up with similarly poor results.

The steps necessary to correct for these deficiencies in DEI have filled books, webinars, and more. Within the confines of this paper, we recommend two best practices:

- Be intentional in recognizing any potential deficits in the diversity and inclusiveness of your team at the board, management, and volunteer levels, because knowing allows you to take action.

- Commit to building the future pipeline of leadership in an intentional way that helps to ensure future generations include a diverse and inclusive group of individuals.

We welcome the opportunity to engage further and share what PNC is doing to improve the DEI efforts for our teams. Our policy is commit endlessly to listening, learning, and acting, both on our own and with the clients and communities we serve. Please reach out to your PNC representative if you would like to continue the discussion.

5. Board Succession Planning

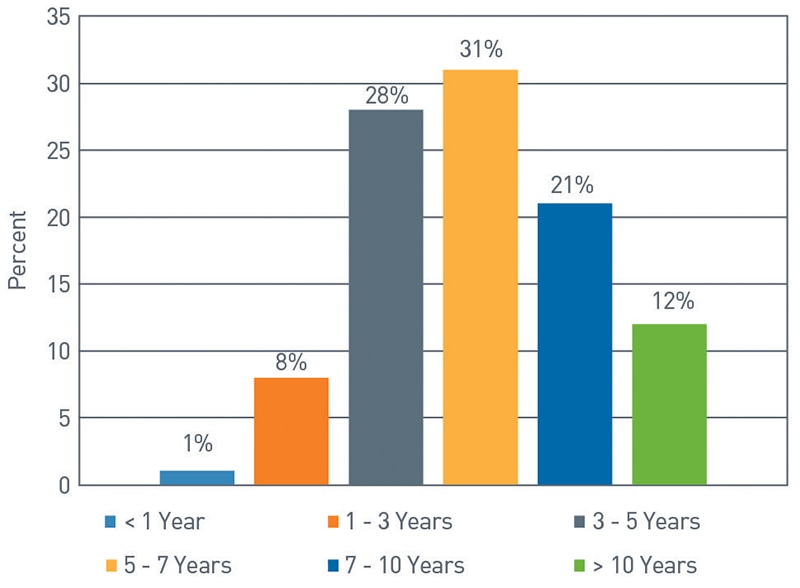

We asked 188 nonprofit organizations in 2020 the question, “How long have you served as a leader with investment input at the nonprofit where you are involved in decision making about the endowment or foundation?”[1]

How Long Have You Served as a Leader with Investment Input?

Source: PNC; numbers may not total 100% due to rounding.

View accessible version of this chart.

The majority of respondents to the survey question indicated they have been with their nonprofit between 3 and 10 years, with 12% even answering they’d been there longer than 10 years. The reason we bring up tenure is with regard to decision-maker turnover: Whether a given nonprofit organization has term limits for board or investment committee members, the committee members leave or move naturally due to other responsibilities or employment changes, or even if board members are approaching retirement age and no longer want to take on management responsibilities, longer tenure can increase the proximity to turnover.

With this in mind, what is your organization’s plan for identifying, training, and promoting the next generation of leadership? A few best practices we have seen include:

- Create a “shadow board,” where the next generation of leadership is paired with the acting board. The shadow board provides fresh input and ideas, and in exchange they get to see existing board members’ decision-making processes and gain valuable experience in the exchange.

- Be intentional about diversity and inclusiveness. Succession planning can be the point where new influences and ideas can bring positive change and progress to the mission. In profiling candidates for vacancies, it is an opportune time to consider, along with experience and personality, other aspects such as gender, age, culture, and, to the extent that it is relevant, geographic location.Have a well-documented plan and commit to both following and periodically reviewing it. As with most things, having a plan goes a long way toward forcing your organization to act.

For more information please see our white paper Succession Planning for Nonprofit Boards and Leadership.

Succession planning matters because, done well, it will help you to think strategically and explicitly about building a next generation of leadership that will help carry the legacy of your organization and its mission into the future.

Conclusion

While the work of US Navy SEALS and the work of leading a nonprofit organization are fundamentally different, we believe nonprofit organizations can learn from the discipline and effort that makes the SEALS so successful. The commitment to always working to improve and to tackling the next challenge is important and can help nonprofit organizations be successful. The right attitude and a few best practices can go a long way toward achieving mission objectives.

Accessible Version of Charts

- 2 or fewer individuals: 12%

- 3 individuals: 31%

- 4 individuals: 28%

- 5 individuals: 16%

- 6 or more individuals: 13%

- 2 or fewer times: 29%

- 3-8 times: 59%

- More than 8 times: 10%

- Mission-Specific: 57%

- Borrowing/Financing: 85%

- Board Governance: 74%

- Fundraising: 65%

- Investment-Related: 62%

- Female: 27%

- Male: 73%

- Law: 12%

- Marketing or Communications: 25%

- Education or Academics: 27%

- Engineering, Mathematics, or Science: 30%

- Government or Public Policy: 32%

- Banking: 47%

- Accounting: 53%

- Technology: 55%

- Investing: 74%

- Less than 1 Year: 1%

- 1-3 Years: 8%

- 3-5 Years: 28%

- 5-7 Years: 31%

- 7-10 Years: 21%

- More than 10 Years: 12%

Let's Talk

Our solutions can be tailored to meet your unique needs.