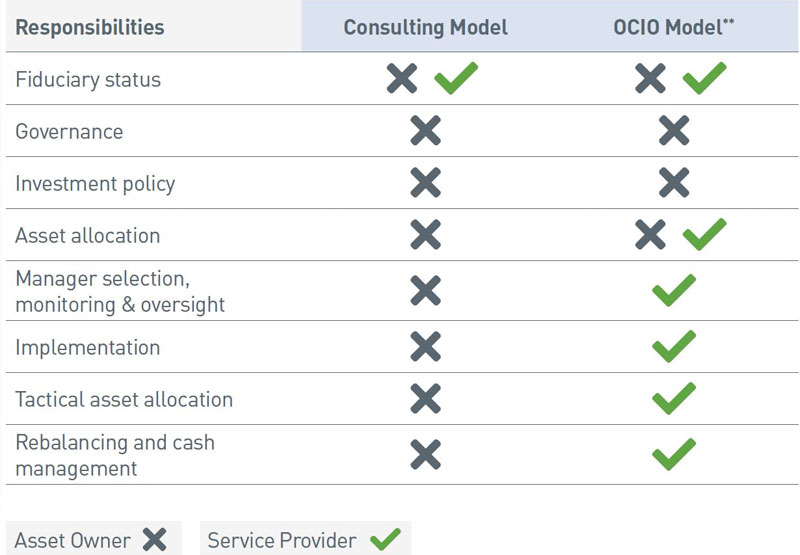

The institutional investment management industry has two primary service models: the traditional consultant model and the outsourced chief investment officer model. It can be important to understand what services each typically offers and what responsibilities the decision makers, such as board or investment committee members, retain in the relationship.

In the traditional consultant model (non-discretionary), an organization contracts with the consultant to provide services such as advising on the investment policy statement (IPS), consulting on asset allocation, recommending investment managers and monitoring performance. In this relationship the investment committee makes the final decisions after the consultant provides information and makes recommendations.

Engaging in an outsourced chief investment officer (OCIO) relationship (discretionary) entails outsourcing some or all investment management decisions to an OCIO provider. In an OCIO relationship, the investment committee provides governance and adopts an IPS for the portfolio. The OCIO must adhere to the IPS framework and guidelines when managing the portfolio. Typical responsibilities of the OCIO provider include portfolio rebalancing, tactical asset allocation decisions, manager selection and performance reporting.

Questions to consider

- Define success. What responsibilities do you want to retain or outsource?*

- Time is valuable. Where is the committee’s time most impactful for success? Do they have the resources and time to make the necessary investment decisions?

- Setting the long-term strategy is critical to success. A transparent provider should be flexible and work with you and tailor to your needs. What steps would the committee want to be actively involved with during the investment process?

View accessible version of this chart.

*Flexibility to retain or outsource responsibilities may be subject to ERISA regulations.

**Example of an OCIO relationship, provider vs. committee decision can vary based on preferences and the allocation of responsibilities should be tailored to the committee’s preferred approach and have the ability to evolve as needed over time

Accessible Version of Charts

Responsibilities |

Consulting Model | OCIO Model** |

| Fiduciary status | Asset owner and service provider | Asset owner and service provider |

| Governance | Asset owner | Asset owner |

| Investment policy | Asset owner | Asset owner |

| Asset allocation | Asset owner | Asset owner and service provider |

| Manager selection, monitoring & oversight | Asset owner | service provider |

| Implementation | Asset owner | service provider |

| Tactical asset allocation | Asset owner | service provider |

| Rebalancing and cash management | Asset owner | service provider |