Since its inception in 1999, Medicare Advantage (MA) has thrived with an upward trajectory of beneficiaries enrolling in various plans. MA, or Medicare Part C, has evolved as plan providers and the Centers for Medicare and Medicaid (CMS) aim to provide more comprehensive and coordinated care options to MA beneficiaries. Unlike traditional Medicare, Medicare Advantage is offered through private insurers who compete for MA beneficiaries via an expanded benefits platform (e.g., vision, dental, gym memberships, etc.). At the same time, most MA plans require the use of “in-network” practitioners, rather than allowing seniors to seek care from any provider of their choice.

Lately, elevated regulatory scrutiny, along with the Biden Administration’s goals to enact greater oversight of MA plans, have been deemed detrimental to some MA structures, which has created some consternation within the payor ecosystem. While MA enrollment and popularity are booming, insurers’ desire to invest in and amass MA lives may be hitting a turning point with upcoming rate cuts, unexpectedly high utilization, and changes to the star ratings program.

In light of this perceived inflection point for MA, several of the ongoing trends impacting MA plans may yield new results. For example, there is increased consolidation among plan providers. As some look to build scale while others look to exit altogether (e.g., Cigna’s recent sale of its MA business to HCSC), this will also likely attract even more regulatory inspection from government agencies, such as the Federal Trade Commission (FTC), Department of Justice (DOJ), or Department of Health and Human Services (HHS). Within an election year, regulators may further increase already-heightened scrutiny of mergers and acquisitions in the space to ensure consolidation does not lead to anti-competitive behavior or harm consumers’ access to affordable and quality healthcare, particularly as plans threaten reductions in benefits and options in the wake of higher costs and reduced margins. Continued regulatory changes and policy reform may impact the structure and operations of MA plans, potentially leading to shifts in reimbursement models, network requirements, and quality metrics.

Further, the larger health insurance companies, with the capacity to pursue broader vertical integration and continuum of care services, will execute on these strategies, acquiring (or partnering) with healthcare providers such as hospitals, physician groups, or home health agencies. Payor-provider integration allows insurers to offer a more comprehensive range of services to MA beneficiaries, albeit at a cost. Moreover, payors may form innovative partnerships with non-traditional healthcare entities, such as technology companies, retail chains, or community-based organizations to enhance the value proposition of their Medicare Advantage plans. These partnerships offer a lower cost avenue for benefits enhancement and may focus on providing additional benefits, improving access to care, and/or addressing the Social Determinants of Health.

In April of this year, the Biden Administration published its final rule for 2025, establishing a 0.16% reduction to payments for insurers, after accounting for the MA risk score trend. This is the second consecutive year for payors earning lower rates for MA plans. The final rule has been met with some backlash from the payor community, but the Biden Administration has unveiled a few other changes to Medicare Advantage that have been received more positively, which has led to overall mixed reception of policy changes for 2024-2025. In addition to the rate cuts, CMS will make enhancements to marketing, prior authorization, and network adequacy standards in 2025. CMS is also setting caps on broker compensation moving forward and is prohibiting the sharing of beneficiary information without the beneficiary’s consent. Plan carriers will also need to gather data and analyze whether prior authorizations damage the broader push for health equity by negatively impacting certain communities. All in all, and in line with broader market forces among healthcare providers, it appears CMS is instituting changes on behalf of the consumer, despite some of the concern that the rate adjustment has elicited from the payor community.

Below, we explore these trends in a bit more depth.

Top Trends Impacting MA in the Near Term

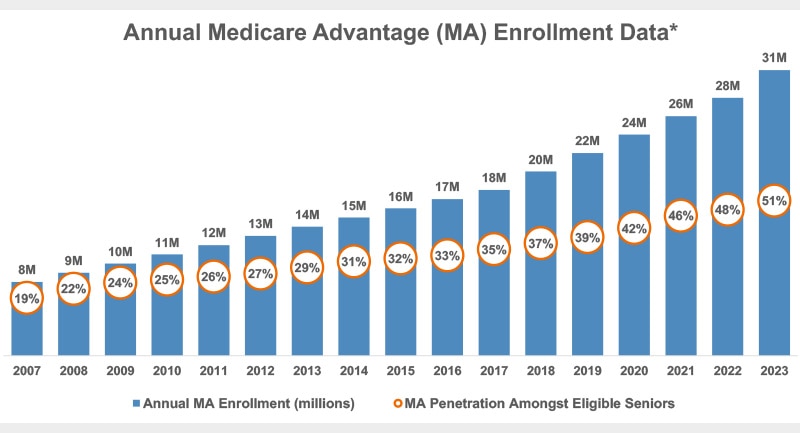

1.Enrollment & Transparency - Now Targeted WITH Data: Medicare Advantage enrollment has been steadily increasing year-over-year through 2023, reaching 51% of eligible Medicare beneficiaries, or about 31 million Americans (KFF). Given the additional benefits that MA enrollees enjoy, it’s historically made sense for those in a position to enroll in Medicare to do so via Medicare Advantage. However, as more and more seniors opt into Medicare Advantage plans, it’s become increasingly important for regulators to foster transparency and consumer-friendly practices.

Figure 1. Annual Medicare Advantage (MA) Enrollment Data*

Source: Kaiser Family Foundation

View accessible version of this chart.

Through the 2024 regulation previously cited, as well as rules to come, the expectation is for regulators to call for greater transparency and consumer empowerment within the MA landscape, including clearer information on plan benefits, costs, provider networks, and quality ratings, as well as more uniform and open practices in marketing to consumers. The latest regulations are believed to be just the tip of the iceberg. Enhancing transparency should help beneficiaries make informed decisions about their healthcare options and hold plans and providers accountable for delivering high-quality, patient-centered care, which may ultimately lead to greater reimbursement for organizations under value-based care (VBC) contracts.

On the topic of transparency, limited interoperability and integration of health data pose challenges to care coordination, care management, and population health management within Medicare Advantage (and in general). However, improving data sharing and interoperability among payers, providers, and other stakeholders can facilitate more seamless care transitions, reduce administrative burden, and support data-driven decision-making to improve outcomes and the patient experience.

2. Expanded Benefits: As stated, Medicare Advantage plans compete on the more diverse and expanded benefits they can offer beyond those that traditional Medicare covers. Still, there's room for improvement in promoting preventative care, health screenings, and healthy lifestyle behaviors among beneficiaries. Increasing engagement in preventative services can help identify and address health risks early, prevent avoidable hospitalizations, promote overall health and well-being among MA members, and address some of the disparate impacts felt by certain populations.

Robust preventative care may also help MA plan beneficiaries reduce the need for high acuity, specialized care in the future, as Medicare Advantage plans typically cover less hyper-specialized and complex care than traditional Medicare. For instance, on the topic of cancer, Dr. Harlan Levine at City of Hope in California recently noted that "40% of Medicare Advantage plans don’t have any National Cancer Institute (NCI)-designated centers in them.”

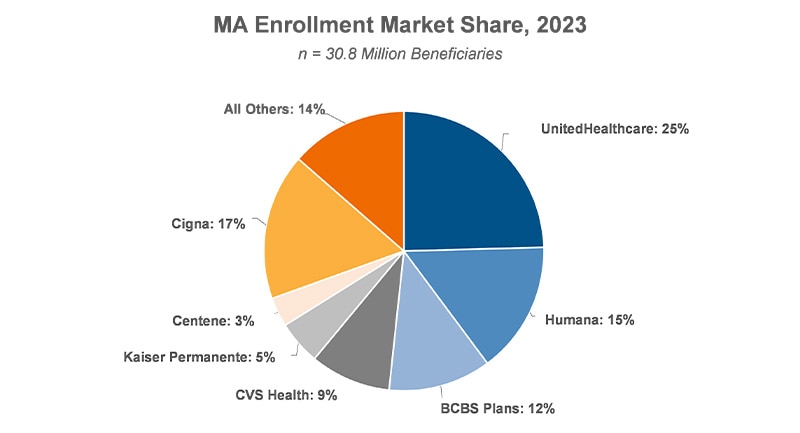

The competitive push for the best benefit design has led to increased participation among seniors, but it has also increased competition among the winners, while smaller MA plan providers negatively impacted by the robust offering sets of the larger, more established payors end up offloading their MA business or seek acquisition altogether. Most recently, Cigna reached an agreement to sell its MA business to HCSC, helping HCSC continue to bolster the MA population it serves. As an added benefit, the sale has allowed Cigna to re-engage merger talks with Humana with fewer anti-trust concerns. For reference, the top four providers of MA plans by market share accounted for almost three-quarters of all MA beneficiaries in 2023 (KFF). The expectation is that larger health insurance companies will continue to acquire smaller Medicare Advantage plan providers to expand their market share and geographic reach. This consolidation allows companies to achieve economies of scale, improve negotiating power with healthcare providers, and enhance administrative efficiency.

Figure 2. MA Enrollment Market Share, 2023

Source: Kaiser Family Foundation

View accessible version of this chart.

However, the future of Medicare Advantage is uncertain. Rising and unexpected costs and Medical Loss Ratios (MLR), along with the CMS proposed rate cut and changes to MA star ratings, are compressing margins for MA plan providers. As a result, many of the largest MA providers are looking to cut benefits, reduce options, and minimize costs going forward. Recently, CVS/Aetna posted an unexpected $900 million loss due to unforeseen utilization among MA plan beneficiaries. Unexpected utilization led to the company reporting an earnings miss for the first quarter of 2024. In addition, a large cohort of insurance companies recently filed suit in federal court against CMS, alleging changes to the star ratings program for the 2024 plan year were against the established rules and led to millions of dollars in lost revenues.

The healthcare industry may have, in fact, reached a tipping point for Medicare Advantage. Now that MA is becoming less lucrative for plan providers, the consolidation that the largest plans have effected may ultimately hurt the consumer in terms of reduced competition, benefit design, and choice.

3. Virtual Health Expansion: During the COVID-19 pandemic, telehealth usage rose significantly (e.g., NYU Langone cited a 700% increase) across the healthcare ecosystem as in-office volume plummeted (NIH). There has been a rapid expansion of telehealth services within MA plans, allowing members to access care remotely. This has been especially beneficial to those MA members in rural and/or under-served areas across the country. However, this service, too, is at risk due to both the statutory regulations and tighter reimbursement policies impacting telemedicine, which is being reigned in post-pandemic. In addition, smaller plans that did not, or could not, incorporate digital infrastructure have been–and will continue to be–challenged due to diminished competitive advantage. This will allow for either more acquisitions by the larger plans or smaller plans opting out of MA offerings altogether.

4. Value-Based Care Models: There's a growing adoption of value-based care models within Medicare Advantage, incentivizing providers to focus on quality of care (namely, improved outcomes 1. and patient satisfaction), rather than volume. There are certain providers, particularly those that still rely on fee-for-service / volume-based reimbursement models that are now more reluctant to treat MA members because of the restrictions for reimbursement predicated on VBC contracts. There is an expectation for adoption of value-based care models within Medicare Advantage to accelerate, with more providers participating in accountable care organizations (ACOs), performance-based contracting, and other alternative payment arrangements to improve quality and cost-effectiveness of care.

MA plans can capitalize on opportunities to improve chronic care management by implementing proactive care coordination, remote monitoring technologies, and personalized interventions to better manage chronic conditions and prevent complications / unnecessary trips to the hospital.

Further, there's a heightened focus on addressing the Social Determinants of Health, such as housing instability and food insecurity, within various MA benefit designs and plans, all in service of improving overall health and narrowing gaps in outcomes felt by disadvantaged communities. Non-medical services, like transportation and home-based care play an integral role in treating MA members and achieving holistic care. Providing more comprehensive coverage not only improves health outcomes, but also enhances the value proposition for MA members. If providers can work more upstream, solving for the issues that lead to disparities in care outcomes, there may be more reimbursement tied to members of MA plans. Notably, in late 2023, CMS released an updated framework for Health Equity through 2032, outlining its five main priorities. CMS also extended the MA Value-Based Insurance Design model through calendar year 2030 (CMS).

Priority 1: Expand the collection, reporting, and analysis of standardized data

Priority 2: Assess causes of ddiparities within CMS Programs, and address inequities in policies and operations to close gaps

Priority 3: Build capacity of healthcare organizations and the workforce to reduce health and healthcare disparities

Priority 4: Advance language access, health literacy, and the provision of culturally tailored services

Priority 5: Increase all forms of accessibility to healthcare services and coverage

View accessible version of this chart.

Source: Kaiser Family Foundation

View accessible version of this chart.

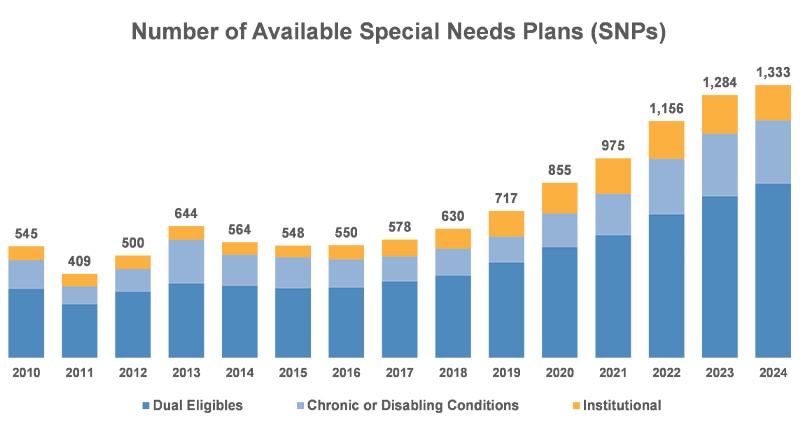

Competition amid the payor community has fostered the current environment of plan flexibility and diverse benefits, and we expect this trend will continue, even while the largest payors by market share keep searching for scale. Moreover, industry-based and legislative efforts to narrow care gaps and address the Social Determinants of Health have led to expanded SNP offerings for eligible MA enrollees.

But disparities in access to care and health outcomes persist within the Medicare Advantage program, particularly among the disabled, racial and ethnic minorities, low-income individuals, and rural populations. Addressing these equity gaps requires targeted interventions, such as culturally competent care, language assistance services, and outreach efforts to under-served communities.

6. Partnerships and Consolidation: Insurers have been forming partnerships and engaging in mergers and acquisitions to expand their Medicare Advantage offerings and reach through a few different avenues: organic growth via market share, growth and scale from a geographical perspective, offering new / differentiated benefits to plan beneficiaries, and/or acquiring competitors. Some insurers may focus on dominating specific regions or local markets by acquiring or partnering with MA plans in those areas. This strategy allows companies to tailor their offerings to the unique needs of local populations and establish a strong presence in targeted geographic areas.

In summary, Medicare Advantage is complex, competitive, and exists in an ever-changing–and relatively nascent–marketplace. All these trends will impact and further complicate that market, likely impacting enrollment, driving more consolidation, and influencing benefit design and overall membership. The current moves toward consumerism and price transparency, all on the back of the “Silver Tsunami,” make it imperative that MA trends be studied and reviewed, as present dynamics could be the early signs of a paradigm shift for Medicare Advantage.

Source

Cigna / HCSC: https://www.hcsc.com/newsroom/news-releases/2024/agreement-acquire-cigna-medicare-careallies-businesses

Cigna / Humana (re-engage): https://www.modernhealthcare.com/mergers-acquisitions/cigna-humana-deal-jeffries

CMS VBID: https://www.cms.gov/priorities/innovation/innovation-models/vbid

CMS Health Equity Framework: https://www.cms.gov/files/document/cms-framework-health-equity-2022.pdf

CVS $900 million Loss: https://www.modernhealthcare.com/finance/cvs-health-aetna-medicare-advantage

Accessible Version of Charts

Figure 1: Annual Medicare Advantage (MA) Enrollment Data

| Annual MA Enrollment (millions) | MA Penetration Amongst Eligible Seniors | |

| 2007 | 8 | 19% |

| 2008 | 9 | 22% |

| 2009 | 10 | 24% |

| 2010 | 11 | 25% |

| 2011 | 12 | 26% |

| 2012 | 13 | 27% |

| 2013 | 14 | 29% |

| 2014 | 15 | 31% |

| 2015 | 16 | 32% |

| 2016 | 17 | 33% |

| 2017 | 18 | 35% |

| 2018 | 20 | 37% |

| 2019 | 22 | 39% |

| 2020 | 24 | 42% |

| 2021 | 26 | 46% |

| 2022 | 28 | 48% |

| 2023 | 31 | 51% |

Source: Kaiser Family Foundation

Figure 2: MA Enrollment Market Share, 2023

| UnitedHealthcare | 29% |

| Humana | 18% |

| BCBS Plans | 14% |

| CVS Health | 11% |

| Kaiser Permanente | 6% |

| Centene | 4% |

| Cigna | 2% |

| All Others | 16% |

Source: Kaiser Family Foundation

Priority 1 |

Expand the collection, reporting, and analysis of standardized data |

Priority 2 |

Assess causes of dsparities within CMS programs, and address inequities in policies and operations to close gaps |

Priority 3 |

Build capacity of healthcare organizations and the workforce to reduce health and healthcare disparities |

Priority 4 |

Advance language access, health literacy, and the provision of culturally tailored services |

Priority 5 |

Increase all forms of accessibility to healthcare services and coverage |

Figure 4: Number of Available Special Needs Plans (SNPs)

| Dual Eligibles | Chronic or Disabling Conditions | Institutional | Total | |

| 2010 | 337 | 140 | 68 | 545 |

| 2011 | 262 | 87 | 60 | 409 |

| 2012 | 321 | 113 | 66 | 500 |

| 2013 | 362 | 214 | 68 | 644 |

| 2014 | 351 | 152 | 61 | 564 |

| 2015 | 339 | 152 | 57 | 548 |

| 2016 | 342 | 139 | 69 | 550 |

| 2017 | 373 | 122 | 83 | 578 |

| 2018 | 401 | 132 | 97 | 630 |

| 2019 | 465 | 127 | 125 | 717 |

| 2020 | 540 | 165 | 150 | 855 |

| 2021 | 598 | 203 | 174 | 975 |

| 2022 | 700 | 272 | 184 | 1156 |

| 2023 | 789 | 306 | 189 | 1284 |

| 2024 | 851 | 309 | 173 | 1333 |

Source: Kaiser Family Foundation