Three years ago in March of 2020, the World Health Organization declared the COVID-19 outbreak a global pandemic. The crisis that befell millions of patients — and the providers who cared for them — will not be soon forgotten. In the aftermath, further turbulence has emerged: labor shortages, inflation, rising interest rates, bank collapses and general uncertainty are compounding in a perfect storm against hospitals and health systems. 2022 was the worst financial year for U.S. hospitals and health systems since the pandemic commenced, with approximately half of hospitals finishing the year with negative operating margins.[1]

- Inflationary pressures from labor costs to supply chain shortages continue to suppress margins. Although government relief funding provided hospitals critical support to address these challenges at the height of the pandemic, these funds have since been depleted, and reimbursements from payors have not risen to offset growing expenses.

- Rising interest rates and market volatility have increased costs of capital and negatively impacted investment portfolios, further pressuring cash flows. Borrowing to fund capital expenditures has become exponentially more expensive when compared with the low interest rate environment of the last several years.

- As these economic headwinds persist, the healthcare industry continues to be disrupted by new players aiming to penetrate the market by offering alternative care-delivery models. Well-funded companies like Amazon, CVS, large retailers and tech companies are offering less expensive and easier-access alternatives to patients when compared to traditional health systems.

In light of these trends, PNC Healthcare surveyed trusted clients from across the country on their top concerns, resulting in insightful dialog around industry trends and the actions being taken to meet these challenges head-on as examined in this article. The participating hospitals and health systems were asked to rank their top three short-term (12-24 months) and long-term (2-5+ years) concerns from a list that included:

- Labor

- Inflation

- Supply chain

- Reimbursements

- Interest rates

- Competition from alternative care providers

- Regulation/legislation

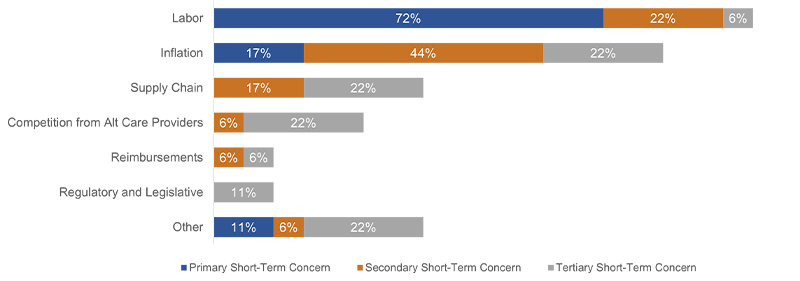

Of the providers polled on short-term concerns, 72% cited labor as their primary concern, while 44% said their secondary concern was inflation. There was a three-way tie for the tertiary concerns between the competition from alternative care providers, supply chain and inflation categories (Chart 1).

Chart 1. Top Short-Term Concerns Ranked by NFP Providers

Source: 2023 PNC Healthcare NFP Provider Survey

View accessible version of this chart.

When asked to use the same list to rank their top three long-term concerns, 61% cited labor as their primary concern, evidencing the industry’s expectation of contending with a tight labor market for years to come. 33% stated that their secondary long-term concern was competition from alternative care providers, representing a notable shift from their short-term concerns and mindfulness of the ongoing disruption within the healthcare industry. It is also worth noting that 28% ranked reimbursements as their secondary long-term concern (Chart 2).

Chart 2. Top Long-Term Concerns Ranked by NFP Providers

Source: 2023 PNC Healthcare NFP Provider Survey

View accessible version of this chart.

Of the providers surveyed, 67% represent larger health systems with more than $2 billion in revenue, while the remaining 33% are below this threshold. Despite the operational differences between hospitals and health systems within these two segments, both groups cited the same rankings of short- and long-term concerns. There was no significant difference noted across geographies; however, smaller hospitals with less-favorable demographic make-up were feeling the pain more intensely.

Virtually all participants ranked labor within their top three short- and long-term concerns. As a result, labor challenges predominantly drove these conversations. The prevailing theme concerning skilled and unskilled labor was not limited to having enough staff in place, but to having the right staff in place as well. “Recruit and retain” was a refrain often repeated in the context of labor shortages. When asked what steps were being taken to address this challenge, many providers pointed to partnering with local universities, offering scholarship opportunities, and enacting leadership development programs, all of which are multi-year strategies.

Labor supply is not at equilibrium with the demand for care, ultimately reducing revenue-generating opportunities. Thus, labor shortages and associated costs are diminishing hospital net income from both the revenue and expense standpoints. Cutting labor costs was a common talking point, with the consensus that it is achievable by reducing or eliminating premium pay for staff. This, of course, is easier said than done as nursing shortages persist in an already tight labor market. Outlooks were positive, however, as progress continues to be made. For example, some health systems told PNC Healthcare that they have created an intra-health system pool of talent that functions similarly to a staffing agency but is comprised of full and part-time employees. This allows full-time employees the flexibility to work from different sites within the broader health system, closing resource gaps for the health system while affording staff the opportunity to travel. For part-time employees, this allows the health system to pull from per diem talent without going through the inefficient process of agency staffing.

Efficiency and productivity were also common themes across participants. These can be directly linked to labor (right staff, right place, right time) but come with a different set of solutions. The providers PNC Healthcare interviewed are focusing on optimizing their schedule, timeslot, and appointment management. Such scheduling enhancements should bolster efficiency and productivity by maximizing existing staffs’ bandwidth. Additionally, several providers posited insourcing currently outsourced functions to bring in new sources of revenue, such as pharmacy and lab capabilities. Further, technological solutions are being used to bolster efficiency and productivity, including virtual care, remote monitoring and robotics for drug dispensing, cleaning, restocking and food delivery.

Sentiments regarding payor reimbursements were lukewarm at best. Relationships with payors are under stress as margins erode. It is hopeful that conditions will improve as contracts are renegotiated; however, that comes with the expectation that denials will increase in tandem, along with anticipated reductions in Medicare/Medicaid reimbursements. Notably, some health systems indicated to PNC Healthcare that when their payor contracts are up for renegotiation, they are aiming to include language protecting them against inflation. Outliers to this tension came from conversations with “payviders,” whose business models are mitigating some of the inflationary pressure felt by traditional providers.

The majority of hospitals and health systems interviewed, regardless of size, have minimal capital projects slated for 2023, with efforts focused on ensuring financial stability. This comes at a time where volatility and uncertainty in the markets is negatively impacting investments. Portfolios that were once considered safety-nets have not been viable sources of liquidity or cash flow for nearly a year, and there is no expectation that market volatility will abate in the near-term. Industry headwinds are negatively impacting operating and non-operating cash flows, and, as a response, the providers surveyed are adopting conservative capital budgets to better match cash flow sources and uses. Moreover, careful prioritization of capital projects is necessary due to elevated borrowing costs. In general, the providers PNC Healthcare surveyed are not actively pursuing M&A opportunities; however, willingness to evaluate these opportunities, as they present themselves, was a common theme.

The aforementioned challenges related to revenue growth, labor costs, inflation, and market volatility are causing hospitals and health systems to deploy cost-cutting strategies, while simultaneously pulling back on capital investments that fuel economic growth in their communities. Given that the healthcare industry represents 20% of GDP and is the leading employer in many communities throughout the U.S., it calls into question how long these challenges will persist and the economic impact they pose in tandem with a dearth of capital investment. This could be a harbinger of negative expectations for the economy and validation that a recession is imminent, if not already here.

If the COVID-19 pandemic showcased anything, it is that the doctors, nurses, and administrators serving the U.S. hospitals and health systems are intelligent, resilient, and innovative — especially in the face of adversity. The industry is changing, and headwinds are not expected to ease up any time soon, but the country’s hospitals are cornerstones in their communities. They are being challenged to adapt and evolve, and they are up to the task.

PNC wishes to thank all the participants in the PNC Healthcare survey. Keeping a finger on the pulse of the healthcare industry and collaborating to find solutions is only possible through solid partnerships with trusted healthcare providers.

Accessible Version of Charts

Chart 1. Top Short-Term Concerns Ranked by NFP Providers

| Primary Short-Term Concern | Secondary Short-Term Concern | Tertiary Short-Term Concern | |

| Other | 11% | 6% | 22% |

| Regulatory and Legislative | 0% | 0% | 11% |

| Reimbursements | 0% | 6% | 6% |

| Competition from Alt Care Providers | 0% | 6% | 22% |

| Supply Chain | 0% | 17% | 22% |

| Inflation | 17% | 44% | 22% |

| Labor | 72% | 22% | 6% |

Source: 2023 PNC Healthcare NFP Provider Survey

Chart 2. Top Long-Term Concerns Ranked by NFP Providers

(view chart)

| Primary Long-Term Concern | Secondary Long-Term Concern | Tertiary Long-Term Concern | |

| Other | 11% | 6% | 6% |

| Regulatory and Legislative | 0% | 6% | 17% |

| Supply Chain | 6% | 6% | 11% |

| Inflation | 6% | 17% | 11% |

| Reimbursements | 6% | 28% | 11% |

| Competition from Alt Care Providers | 11% | 33% | 22% |

| Labor | 61% | 6% | 22% |

Source:2023 PNC Healthcare NFP Provider Survey